03 Feb 3 ways an IUL can help pay for college | CollegePLUS IUL

An IUL can help Pay for College

College costs are skyrocketing, leaving parents scrambling for solutions to afford their children’s education. While financial aid can ease some of the burden, many parents still face significant expenses. An Indexed Universal Life insurance policy (IUL) emerges as a strategic tool for funding college education.

Understanding Indexed Universal Life Insurance is crucial. It’s a permanent life insurance policy, providing coverage as long as premiums are paid. A portion secures a death benefit, while the rest is invested in an interest-bearing account, accumulating cash value.

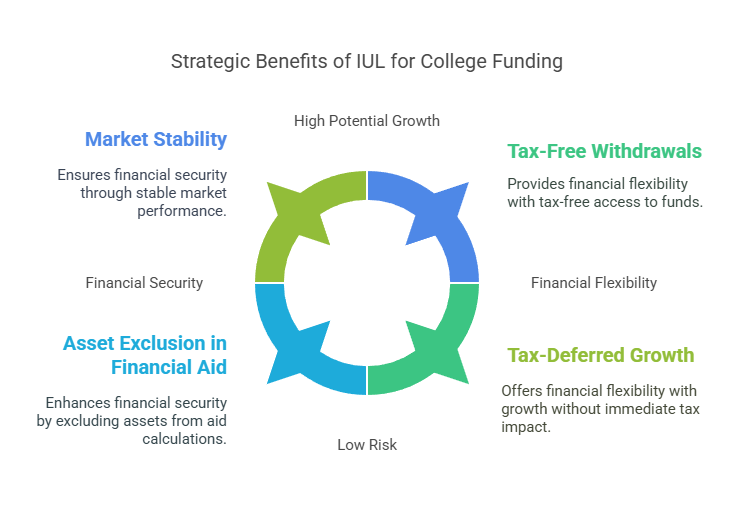

Key reasons to consider Indexed Universal Life Insurance for college expenses:

Tax Advantages:

The cash value grows tax-deferred, with potential tax-free withdrawals. Loan distributions are usually tax-free too, offering flexibility in funding college without added tax burdens.

Lower Investment Risk:

IUL ensures the cash value continues to grow, even in poor market conditions, protecting the death benefit. This stability shields against market volatility, providing peace of mind.

Financial Aid:

Life insurance typically isn’t considered an asset in financial aid calculations. By leveraging IUL, parents can potentially increase their child’s eligibility for financial aid.

As college costs rise, IUL proves advantageous in the long term. Allowing the cash account to grow avoids premature withdrawals. Certain insurers may require a minimum cash balance to maintain the policy.

In conclusion, The Policy Shop‘s CollegePLUS IUL policy goes beyond being a mere college savings plan. It’s a strategic investment in your child’s education, coupled with the long-term security of life insurance coverage. The dual functionality, full downside protection, flexibility in fund usage, and tax-free growth make it a comprehensive and forward-thinking solution for parents who aspire to provide the best for their children’s future. With the CollegePLUS IUL policy, you’re not just investing in education; you’re investing in a lifetime of financial well-being.

—————————————————————————————————————————————————————————————

Related Content | Learn More about IULs:

What is Indexed Universal Life Insurance?

Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that lasts your whole life and has two main parts: a death benefit that pays out when you pass away, and a cash value component that can grow over time. What sets IUL apart from other types of life insurance is how the cash value grows. Instead of just earning a set interest rate, the cash value in an IUL policy can also increase based on the performance of an underlying stock market index, like the S&P 500.

How The IUL Works:

When the index goes up, your cash value goes up too, but only up to a certain limit, called a “cap.” For example, if your policy has a cap of 7% and the index goes up by 8%, your cash value would only increase by 7%. However, if the index goes down, your cash value won’t lose any value – it stays the same, protecting your money from market losses.

The cash value in your IUL policy grows tax-deferred, meaning you don’t pay taxes on it until you withdraw the money. This allows your cash value to grow faster over time. Plus, because IUL is permanent life insurance, your loved ones are protected financially with a tax-free death benefit when you pass away, as long as you keep paying the premiums.

What are IUL insurance riders?

IUL policies also offer various optional add-ons called riders that can enhance your coverage. here is a list of the best:

- Adjustable Term Insurance Rider: Adds a term life insurance component to your policy for extra coverage.

- Additional Insured Rider: Extends coverage to your spouse or children.

- Long-Term Care Rider: Provides income to cover long-term care expenses like nursing home or home care.

- Chronic Illness Rider: Pays out a portion of the death benefit if you’re diagnosed with a chronic illness.

- Accelerated Benefit Rider: Provides a portion of the death benefit early if you’re diagnosed with a terminal illness.

Our team of IUL experts can help you decide if an indexed universal life insurance policy is right for your financial needs.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.