04 Feb Navigating Life Insurance with Confidence

Navigating Life Insurance

Why is life insurance more than just a financial decision?

In the tapestry of life, unexpected twists and turns are inevitable. That’s why having a robust life insurance policy is not just a financial decision—it’s a lifeline for you and your loved ones. Take, for instance, the story of the Smith family. When tragedy struck and Mr. Smith unexpectedly passed away, leaving behind a young family and a mortgage to pay, it was their life insurance policy that provided a sense of security and stability during their darkest hour.

At The Policy Shop, we understand the importance of life insurance in protecting your family’s financial future. With our comprehensive coverage options and competitive rates, we’ve helped countless families like the Smiths weather life’s storms and emerge stronger than ever.

What are the different types of life insurance, and how do you choose?

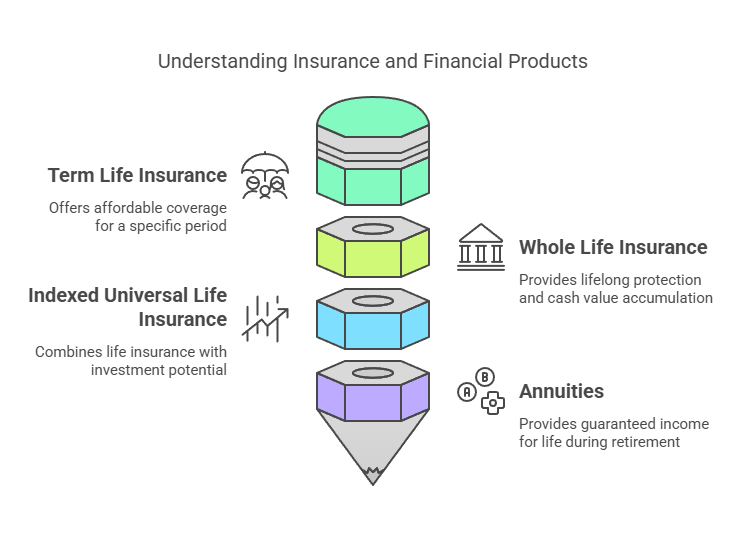

From term life insurance, which offers affordable coverage for a specific period, to whole life insurance, which provides lifelong protection and cash value accumulation, we have solutions to fit every need and budget. And with our team of experienced agents by your side, you can navigate the complexities of life insurance with confidence, knowing that you’re making the right choices for your family’s future.

How can life insurance protect your loved ones’ future?

Don’t leave your loved ones’ future to chance. Secure their financial well-being with life insurance from The Policy Shop.

IULs (Indexed Universal Life Insurance)

When it comes to financial planning, having a strategy that adapts to life’s ever-changing landscape is essential. That’s where Indexed Universal Life Insurance (IUL) shines. Take, for example, the case of Sarah, a young professional looking to secure her financial future. With WealthX Indexed Universal Life (IUL) policy from The Policy Shop, Sarah not only protects her loved ones with guaranteed death benefit coverage but also builds cash value that grows tax-deferred over time.

What makes IUL a powerful wealth-building tool?

The power of IUL lies in its flexibility and potential for growth. By linking the policy’s cash value to the performance of market indices, individuals like Sarah can harness the upside potential of the market while enjoying downside protection—a winning combination in today’s uncertain economic climate.

Why is IUL a strong alternative to traditional savings?

But don’t just take our word for it. Historical data speaks volumes about the effectiveness of IUL as a long-term wealth-building strategy. Over the years, IUL policies have consistently outperformed traditional savings vehicles, providing policyholders with both security and growth potential.

How can an IUL help with retirement, college savings, and legacy planning?

So whether you’re planning for retirement, saving for your child’s education, or simply looking to build wealth for the future, consider the power of Indexed Universal Life Insurance from The Policy Shop. With our innovative solutions and personalized guidance, you can chart a course to financial freedom with confidence.

Annuities

Why are annuities essential for retirement planning?

As the sun sets on your career and you set sail into retirement, having a reliable source of income becomes paramount. That’s where annuities come in. Picture this: John and Mary, a retired couple enjoying their golden years. With RetirementPAYDAY Annuity from The Policy Shop, they have the peace of mind knowing that their retirement income is guaranteed for life, regardless of market fluctuations or economic uncertainty.

How do annuities provide flexibility and peace of mind?

Annuities have long been heralded as a cornerstone of retirement planning, offering a steady stream of income to support your lifestyle and cover essential expenses. But what sets RetirementPAYDAY Annuity apart is its flexibility and security. With options for immediate or deferred income, fixed or indexed accounts, you can tailor your annuity to meet your specific needs and goals, whether you’re looking for predictable income or growth potential.

Have annuities stood the test of time?

And when it comes to reliability, look no further than the historical performance of annuities. Dating back centuries, annuities have stood the test of time, providing financial security and peace of mind to generations of retirees.

How can annuities help you retire with confidence?

So as you embark on your retirement journey, consider the power of annuities from The Policy Shop. With our comprehensive solutions and personalized guidance, you can navigate the seas of retirement with confidence, knowing that your financial future is in good hands.

Term Life Insurance

How can term life insurance protect your family’s financial future?

Life is full of uncertainties, but your family’s financial security shouldn’t be one of them. That’s where term life insurance comes in. Meet Sarah, a young mother of two. With a mortgage to pay and children to support, Sarah knows that life insurance is not just a luxury—it’s a necessity.

Is term life insurance affordable and flexible?

With term life insurance from The Policy Shop, Sarah can rest easy knowing that her family’s financial future is secure, no matter what life throws their way. And the best part? Term life insurance is affordable and flexible, making it the perfect solution for young families like Sarah’s.

Can term life insurance support older adults too?

But don’t just take our word for it. Consider the case of John, a recent retiree looking to supplement his savings. With term life insurance, John can enjoy peace of mind knowing that his loved ones will be taken care of in the event of his passing, without breaking the bank.

Who should consider term life insurance?

So whether you’re just starting your journey into parenthood or enjoying your retirement years, consider the power of term life insurance from The Policy Shop. With our comprehensive coverage options and competitive rates, you can protect what matters most with confidence.

Whole Life Insurance

What happens to your assets when you’re gone?

Life is a journey, and along the way, we accumulate memories, experiences, and assets. But what happens to those assets when we’re gone? That’s where whole life insurance comes in. Meet David, a successful entrepreneur looking to leave a legacy for future generations. With whole life insurance from The Policy Shop, David can rest easy knowing that his loved ones will be taken care of long after he’s gone.

Why choose whole life insurance for legacy planning?

Whole life insurance offers more than just financial security—it offers peace of mind and the opportunity to build a legacy that lasts a lifetime. With guaranteed coverage and cash value accumulation, whole life insurance is the perfect solution for individuals like David who want to leave a lasting impact on the world.

Is whole life insurance a reliable, time-tested option?

And when it comes to reliability, consider the historical performance of whole life insurance. Dating back centuries, whole life insurance has provided financial security and peace of mind to generations of families, ensuring that their legacies live on for years to come.

Who should consider whole life insurance?

So whether you’re a young professional just starting your journey or a seasoned entrepreneur looking to leave a legacy, consider the power of whole life insurance from The Policy Shop. With our comprehensive coverage options and personalized guidance, you can build a legacy that lasts a lifetime with confidence.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.