03 Feb Wealth Protection Strategies: IULs vs. Asset Protection Trusts

IULs Asset Protection Trusts

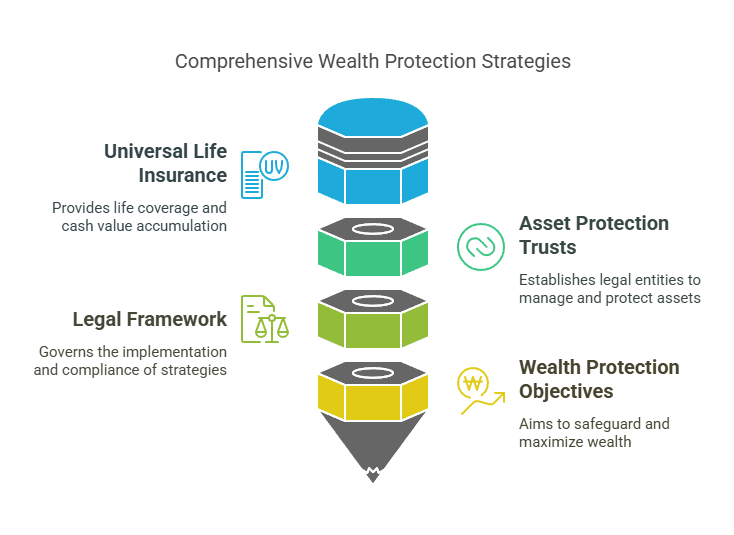

Safeguarding Prosperity: Comparing Universal Life Insurance and Asset Protection Trusts

Introduction: Safeguarding Prosperity | Comparing Universal Life Insurance and Asset Protection Trusts

Welcome to this comprehensive exploration of wealth protection strategies. In this article, we delve into two powerful tools—universal life insurance policies and asset protection trusts—and their pivotal roles in securing assets, mitigating liabilities, and preserving wealth for generations to come. By understanding the intricacies of both options, individuals and families can make informed decisions to safeguard their financial futures.

Universal Life Insurance Policies: A Shield for Your Assets

Universal life insurance policies stand as a stalwart defense against financial uncertainties. With features designed to accumulate cash value and provide death benefit protection, these policies offer more than just life insurance coverage—they serve as a fortress for your wealth. Through careful structuring, universal life insurance can shield assets from creditors, lawsuits, divorce settlements, and other unforeseen risks, providing a vital layer of protection for your financial legacy.

Asset Protection Trusts: Fortifying Your Financial Future

On the other hand, asset protection trusts represent a time-tested strategy for fortifying your financial future. By establishing a legal entity to hold and manage assets, individuals can safeguard their wealth from external threats and preserve it for future generations. Asset protection trusts offer flexibility in trustee arrangements, jurisdictional considerations, and asset transfer restrictions, empowering individuals to tailor their wealth protection strategies to their specific needs and objectives.

Comprehensive Asset Protection Solutions

Both universal life insurance policies and asset protection trusts offer unique advantages in safeguarding assets and minimizing liabilities. By combining the strengths of these two strategies, individuals and families can create comprehensive asset protection solutions that provide unparalleled security and peace of mind. Whether it’s leveraging the cash value accumulation of a universal life insurance policy or establishing an asset protection trust to shield assets from legal challenges, the possibilities for safeguarding wealth are vast and varied.

Join us on this journey as we explore the nuances of universal life insurance policies and asset protection trusts, uncovering the strategies and tactics that can help you secure your financial legacy for generations to come. Let’s embark on this enlightening exploration together, empowering you to make informed decisions and protect what matters most.

Key Points:

Asset Protection Objectives:

Asset protection strategies serve various objectives, primarily focused on shielding assets from potential risks and threats. These include safeguarding assets from creditors seeking repayment, mitigating the impact of lawsuits or legal judgments, protecting assets in divorce settlements, and minimizing exposure to other financial risks. By implementing robust asset protection measures, individuals and families can fortify their financial security and preserve wealth for future generations.

Universal Life Insurance Overview:

Universal life insurance policies offer multifaceted benefits beyond traditional life insurance coverage, making them effective tools for asset protection. These policies feature cash value accumulation, allowing policyholders to build a financial cushion over time. Additionally, universal life insurance provides death benefit protection, ensuring beneficiaries receive a tax-free payout upon the policyholder’s death. Moreover, in certain jurisdictions, universal life insurance policies offer creditor protection, shielding the cash value and death benefit from potential creditors’ claims.

Asset Protection Trust Basics:

Asset protection trusts are foundational components of comprehensive wealth protection strategies. Understanding their fundamentals is crucial for individuals seeking to safeguard their assets. Asset protection trusts are established legal entities designed to hold and manage assets on behalf of beneficiaries. They feature flexible trustee arrangements, allowing individuals to designate trustees who will manage the trust assets according to their wishes. Asset protection trusts also involve jurisdictional considerations, as the laws governing these trusts vary by jurisdiction, impacting their effectiveness in shielding assets from legal challenges and creditors’ claims.

Legal and Regulatory Framework:

Navigating the legal and regulatory landscape is essential when implementing asset protection strategies involving universal life insurance policies and asset protection trusts. Understanding the legal framework governing these instruments is crucial for ensuring compliance and maximizing their effectiveness. State laws play a significant role, as they dictate the rules and regulations governing universal life insurance policies and asset protection trusts. Additionally, considering tax implications and compliance requirements is vital for structuring asset protection strategies that align with individuals’ financial goals and objectives.

Comprehensive Wealth Protection:

By synergizing universal life insurance policies and asset protection trusts, individuals can create comprehensive wealth protection solutions that provide robust asset protection and preserve prosperity for future generations. Leveraging the strengths of each strategy, individuals can shield assets from potential risks and threats while maximizing wealth accumulation and distribution opportunities. Whether it’s utilizing the cash value accumulation feature of universal life insurance policies or establishing asset protection trusts to shield assets from legal challenges, comprehensive wealth protection strategies offer unparalleled security and peace of mind.

Conclusion:

Universal Life Insurance

Universal life insurance policies and asset protection trusts stand as formidable pillars of wealth protection, providing individuals and families with robust strategies to safeguard their assets and preserve prosperity for future generations. Each option offers unique features and benefits, allowing individuals to tailor their asset protection plan according to their specific needs and objectives.

By comprehensively understanding the capabilities of universal life insurance policies and asset protection trusts, individuals can design a holistic asset protection strategy that addresses potential risks and threats effectively. Universal life insurance policies offer flexibility, cash value accumulation, death benefit protection, and creditor protection in certain jurisdictions, making them versatile tools for wealth preservation.

Asset Protection

Asset protection trusts, on the other hand, provide a structured legal framework for holding and managing assets, offering enhanced protection against creditors and legal challenges. With flexible trustee arrangements and jurisdictional considerations, asset protection trusts enable individuals to shield their assets while maintaining control and flexibility over their wealth.

By integrating both universal life insurance policies and asset protection trusts into their financial plan, individuals can create a comprehensive asset protection strategy that safeguards their assets and preserves prosperity for future generations. Whether it’s protecting against creditor claims, legal judgments, or divorce settlements, these wealth protection strategies offer unparalleled security and peace of mind.

To explore your wealth protection options and secure your financial legacy for generations to come, contact The Policy Shop today. Our team of experts is dedicated to helping you navigate the complexities of asset protection and design a tailored strategy that aligns with your financial goals and objectives. With our guidance, you can build a solid foundation for wealth preservation and ensure a prosperous future for yourself and your loved ones.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.