03 Feb Life Insurance and Taxes: How to Secure Your Financial Future

Tax implications of life insurance

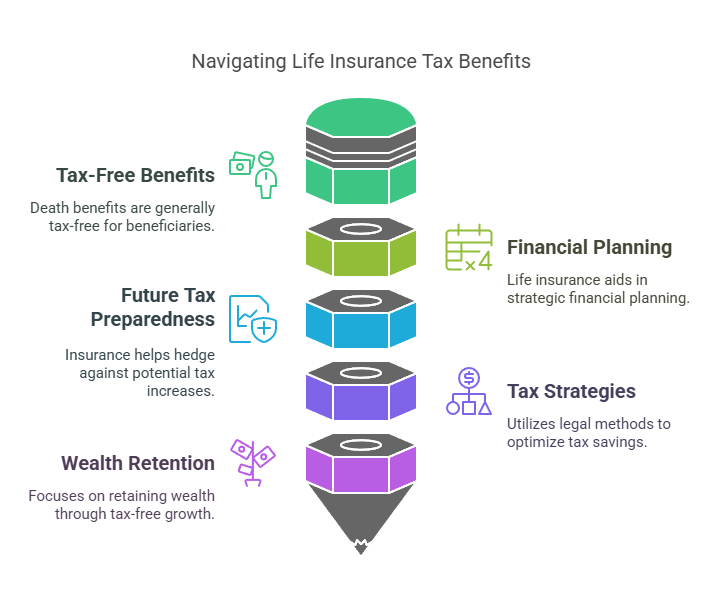

Life insurance is more than just protection for your loved ones—it’s also a strategic financial tool with unique tax advantages. Understanding the tax implications of life insurance can help you make informed decisions to safeguard your assets and provide for your family’s future. In this article, we’ll explore why life insurance is tax-free, how it can help you prepare for future tax changes, and the importance of tax-free growth in financial planning

-

Why Is Life Insurance Tax-Free

Life insurance is known for its unique tax advantages. The death benefit provided by life insurance is generally income tax-free, meaning your beneficiaries typically won’t have to pay taxes on the amount they receive. The tax-free nature of life insurance is a significant benefit, making it an attractive choice for estate planning and providing financial security for your loved ones. Understanding why life insurance is tax-free can help you leverage this financial tool to protect your assets and provide for your family’s future.

-

Are You Prepared for the Future of Taxes?

The future of taxes is uncertain, with potential increases on the horizon. It’s essential to be proactive and prepare for these changes. While nobody can predict with absolute certainty how tax policies will evolve, having a well-thought-out financial strategy in place is your best defense. Our policies can help you prepare for future tax hikes. By exploring these options, you can position yourself to minimize the impact of increased taxes on your wealth. Don’t wait until tax changes catch you off guard; start planning now to secure your financial future.

-

Tax Free, not Tax Deferred

When it comes to growing your wealth, understanding the difference between tax-free and tax-deferred growth is crucial. Many financial tools offer tax-deferred growth, meaning you delay paying taxes until you withdraw the funds. However, WealthX & CollegPLUS provide tax-free growth, where your earnings are not subject to taxation, offering a substantial advantage. This tax-free growth can make a significant difference in the long term, helping you keep more of your hard-earned money. Exploring tax-free financial tools is a smart move that can lead to a brighter financial future and better control over your wealth.

-

Do This to Save Tax

Saving on taxes is a goal for many individuals, and smart financial planning can help you achieve it. There are strategies you can implement to reduce your tax burden. One powerful approach of our WealthX | CollegPLUS policies is to take advantage of financial tools that offer tax benefits. By exploring these tax-efficient options, you can minimize the amount you owe to the government, ultimately keeping more of your money in your pocket. It’s not about evading taxes but about leveraging the legal and legitimate methods available to save on your tax bill.

-

Are You Hedged Against Tax Increases?

With the uncertainty of future tax increases, it’s essential to ask yourself if you’re adequately hedged against these potential changes. Our policies can help you minimize the impact of tax hikes. Protecting your wealth from the negative effects of increased taxes ensures you can continue to grow your assets without being burdened by unnecessary tax expenses. Being hedged against tax increases is a crucial aspect of securing your financial future.

Conclusion:

As you navigate the complexities of life insurance and taxes, remember that our policies at The Policy Shop offer tailored solutions to suit your specific financial goals. Whether you’re looking for tax-free growth, protection against future tax increases, or strategies to minimize your tax burden, our team of experts is here to help. Book an appointment today and let us guide you in building the right policy to secure your financial future.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.