04 Feb CollegePLUS Indexed universal Life Insurance for children

Introducing our College Funding Focused IUL

Unlocking Future Prosperity: The CollegePLUS Indexed Universal Life Insurance Policy by The Policy Shop.

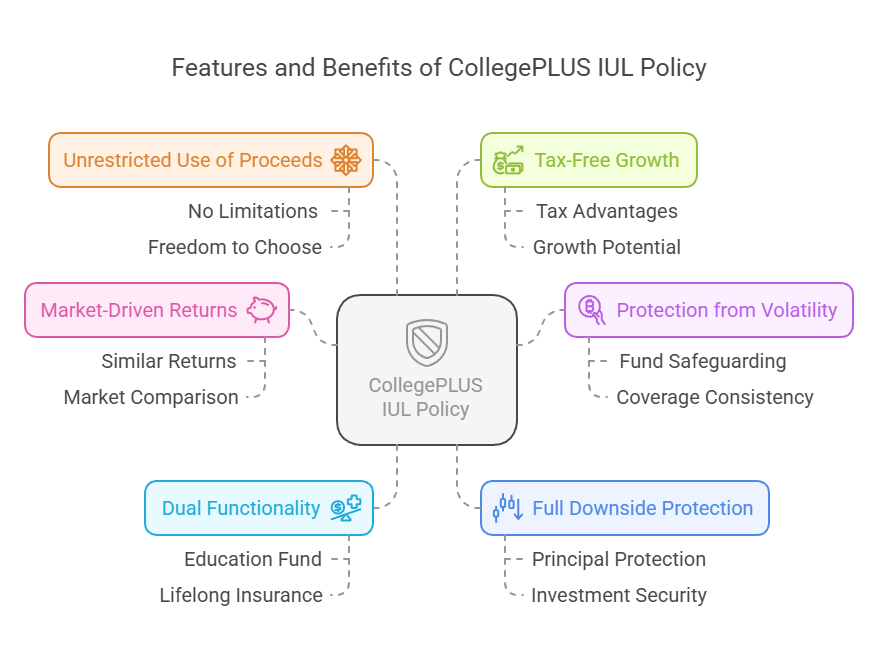

In the realm of financial planning, The Policy Shop stands out with its innovative CollegePLUS IUL policy (Indexed universal Life Insurance for children), a multifaceted solution that not only paves the way for your child’s education costs but doubles as lifelong life insurance coverage. Let’s explore the unique features that make the CollegePLUS (Indexed universal Life Insurance for children) policy a game-changer.

1. A Shield for Your Child’s Education

Traditional college savings plans come with limitations and uncertainties, restricting your investment gains for education use only. The CollegePLUS (Indexed universal Life Insurance for children) policy redefines the game by offering market-driven returns similar to traditional college savings plans, but with meaningful additional benefits. This policy acts as a shield, safeguarding your child’s education fund from market volatility and unforeseen financial challenges.

2. Beyond College: Lifelong Coverage

One standout feature of the CollegePLUS policy is its dual functionality. While primarily designed to fund your child’s education, it extends far beyond that. This policy doubles as life insurance, providing coverage for your child throughout their entire life. This means you’re not just investing in their education; you’re securing their financial future regardless of life’s uncertainties.

3. Full Downside Protection: Security Amid Market Swings

In a world where the stock market can be unpredictable, the CollegePLUS policy offers unparalleled security with full downside protection. Even if the market experiences a downturn, your principal remains safeguarded from risk. This unique feature ensures that, no matter what twists and turns the financial landscape takes, your child’s education fund and life insurance coverage remain intact.

4. Unrestricted Use of Proceeds: Flexibility for Life’s Opportunities

The CollegePLUS policy doesn’t just offer financial security; it provides unmatched flexibility. Unlike traditional college savings plans with strict usage limitations, this policy allows you unrestricted use of proceeds. Whether it’s for education, starting a business, or any other life opportunity, you have the freedom to access your funds on your terms.

5. Tax-Free Growth: A Smart Financial Move

Understanding the tax implications of your financial choices is crucial. The CollegePLUS policy comes with tax advantages, offering tax-free growth on your investment. This not only maximizes the growth potential of your child’s education fund but also adds an extra layer of financial efficiency to your overall strategy.

In conclusion, The Policy Shop’s CollegePLUS policy goes beyond being a mere college savings plan. It’s a strategic investment in your child’s education, coupled with the long-term security of life insurance coverage. The dual functionality, full downside protection, flexibility in fund usage, and tax-free growth make it a comprehensive and forward-thinking solution for parents who aspire to provide the best for their children’s future. With the CollegePLUS policy, you’re not just investing in education; you’re investing in a lifetime of financial well-being.

—————————————————————————————————————————————————————————————

Related Content | Learn More about IULs:

What is Indexed Universal Life Insurance?

Here is the best explanation:

Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that lasts your whole life and has two main parts: a death benefit that pays out when you pass away, and a cash value component that can grow over time. What sets IUL apart from other types of life insurance is how the cash value grows. Instead of just earning a set interest rate, the cash value in an IUL policy can also increase based on the performance of an underlying stock market index, like the S&P 500.

How The IUL Works:

When the index goes up, your cash value goes up too, but only up to a certain limit, called a “cap.” For example, if your policy has a cap of 7% and the index goes up by 8%, your cash value would only increase by 7%. However, if the index goes down, your cash value won’t lose any value – it stays the same, protecting your money from market losses.

The cash value in your IUL policy grows tax-deferred, meaning you don’t pay taxes on it until you withdraw the money. This allows your cash value to grow faster over time. Plus, because IUL is permanent life insurance, your loved ones are protected financially with a tax-free death benefit when you pass away, as long as you keep paying the premiums.

What are IUL insurance riders?

IUL policies also offer various optional add-ons called riders that can enhance your coverage. here is a list of the best:

- Adjustable Term Insurance Rider: Adds a term life insurance component to your policy for extra coverage.

- Additional Insured Rider: Extends coverage to your spouse or children.

- Long-Term Care Rider: Provides income to cover long-term care expenses like nursing home or home care.

- Chronic Illness Rider: Pays out a portion of the death benefit if you’re diagnosed with a chronic illness.

- Accelerated Benefit Rider: Provides a portion of the death benefit early if you’re diagnosed with a terminal illness.

Our team of IUL experts can help you decide if an indexed universal life insurance policy is right for your financial needs.

Stay tuned for regular updates and subscribe to our newsletter for the latest industry trends and exclusive offers. Trust The Policy Shop to be your ultimate resource for all things Life insurance related. Start your journey to financial security today!

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.