27 Jan A Comparison of Term vs. Permanent Policies

Choosing the Right Life Insurance:

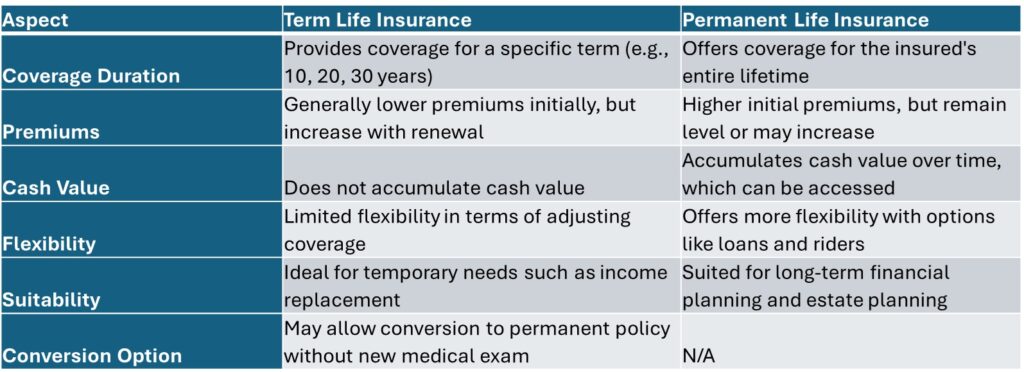

When it comes to life insurance, selecting the right type can be a crucial decision with long-term implications. Term and permanent life insurance are two primary options, each with distinct features and benefits. In this article, we’ll delve into the differences between these policies, exploring their pros and cons to help you make an informed decision that aligns with your financial goals and needs.

Choosing between Term and Permanent Life Insurance?

Term Life Insurance:

-

- Offers coverage for a specific period, typically 10, 20, or 30 years.

- Provides death benefit protection for your beneficiaries if you pass away during the term.

- Generally more affordable compared to permanent life insurance.

- Doesn’t accumulate cash value.

Permanent Life Insurance:

-

- Provides coverage for your entire life, as long as premiums are paid.

- Accumulates cash value over time, which can be accessed through policy loans or withdrawals.

- Offers lifelong protection and can serve as an investment vehicle.

- Premiums are typically higher than term life insurance.

Tailor your coverage for financial peace of mind:

When choosing between term and permanent life insurance, consider your long-term financial goals, budget, and coverage needs. Term life insurance may be suitable for short-term needs, such as covering a mortgage or providing for children’s education, while permanent life insurance offers lifelong protection and cash value accumulation. Evaluate your options carefully to make an informed decision that aligns with your financial objectives.

Deciding between term and permanent life insurance involves careful consideration of various factors, including your budget, coverage needs, and long-term financial objectives. While term insurance may be suitable for short-term needs, permanent life insurance offers lifelong protection and additional benefits like cash accumulation. By understanding the distinctions outlined in this comparison, you can confidently choose the policy that best serves your unique circumstances and provides financial security for you and your loved ones.

Contact us today to begin your journey toward securing your legacy with The Policy Shop. Together, we’ll create a brighter tomorrow for you and your loved ones.