27 Jan Exploring Cash Value in Life Insurance

Cash Value in Life Insurance

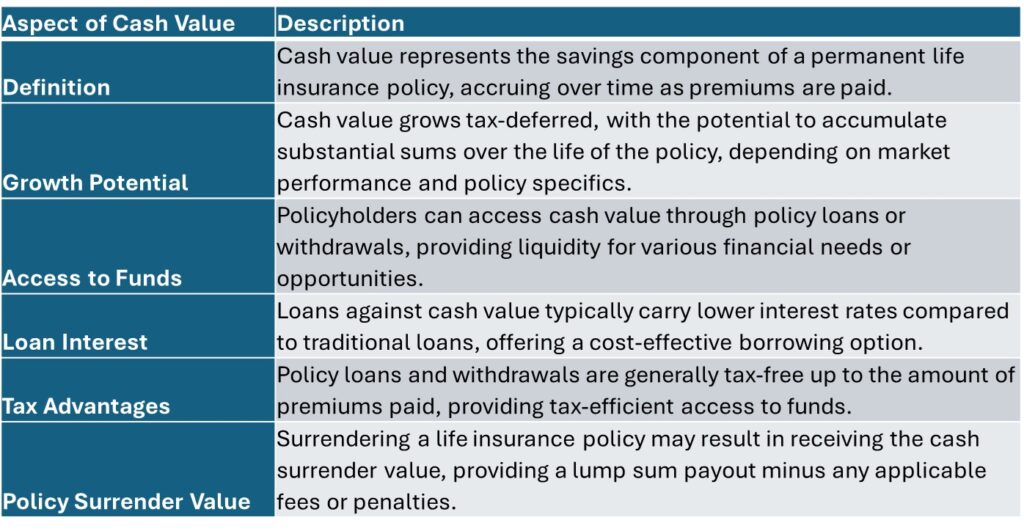

Life insurance offers more than just protection; it can also serve as a valuable financial asset through the accumulation of cash value. Understanding cash value and its potential benefits is essential for maximizing the utility of life insurance policies within your overall financial portfolio. This exploration delves into the concept of cash value, its significance, and how it can contribute to long-term financial stability and growth.

Understanding Cash Value in Life Insurance

Cash Value Benefits:

- Tax-Deferred Growth: Cash value grows on a tax-deferred basis, allowing for potential tax savings.

- Access to Funds: Policyholders can access cash value through policy loans or withdrawals for various financial needs.

- Asset Protection: Cash value serves as a valuable asset in your financial portfolio and can provide a source of liquidity during emergencies.

Harness the power of cash value in your financial planning:

Cash value life insurance offers more than just death benefit protection—it provides a unique combination of insurance coverage and cash value accumulation. By understanding the role of cash value in your policy, you can unlock its potential as a financial asset for long-term planning. Whether you’re looking to supplement retirement income, fund education expenses, or cover unexpected costs, cash value life insurance offers flexibility and security. Explore the benefits of cash value and incorporate it into your financial strategy for a secure future.

Cash value represents a unique feature of permanent life insurance policies, offering policyholders a versatile financial asset that can contribute to long-term wealth accumulation and financial security. By understanding the concept of cash value and its potential benefits, individuals can leverage life insurance as a valuable tool within their overall financial portfolio. Whether seeking supplemental retirement income, emergency funds, or investment opportunities, cash value provides flexibility and liquidity to meet diverse financial needs. Through informed decision-making and strategic planning, individuals can optimize the value of their life insurance policies and unlock their full financial potential.

Contact us today to begin your journey toward securing your legacy with The Policy Shop. Together, we’ll create a brighter tomorrow for you and your loved ones.