03 Feb Leveraging Premium Financing for High-Net-Worth Individuals: BespokeFINANCE

Premium Financing for High-Net-Worth Individuals:

Welcome to The Policy Shop’s exclusive guide on premium financing life insurance for high-net-worth individuals. This guide (BespokeFINANCE: Leveraging Premium Financing for High-Net-Worth Individuals) will provide a deep dive into how our BespokeFINANCE strategy can be a powerful tool in your wealth management arsenal, allowing you to leverage life insurance in a way that maximizes your financial potential while minimizing out-of-pocket expenses.

Understanding Premium Financing

Premium financing is a sophisticated financial strategy that allows individuals with significant wealth to obtain life insurance without liquidating other investments. Instead of paying premiums out-of-pocket, you can borrow the necessary funds, typically from a bank or financial institution. The borrowed amount is then used to pay the premiums on a high-value life insurance policy, often a permanent life insurance policy like Whole Life or Indexed Universal Life (IUL).

The Role of Life Insurance in Wealth Management

Life insurance, especially cash value policies like IULs, plays a crucial role in wealth management. These policies offer not only a death benefit but also a cash value component that grows over time. This cash value can be accessed through loans or withdrawals, providing liquidity while still protecting your family’s financial future. Premium financing amplifies these benefits by enabling you to acquire larger policies than you might otherwise be able to afford, using the policy’s cash value as collateral for the loan.

Why Premium Financing is Ideal for High-Net-Worth Individuals

For high-net-worth individuals, premium financing is particularly attractive because it allows you to preserve your cash flow and continue investing in high-performing assets while still securing a substantial life insurance policy. This strategy is most effective when the expected return on your investments exceeds the interest rate on the loan used for premium financing. In essence, you’re using leverage—an approach commonly employed in real estate and other investment strategies—to enhance your wealth-building potential.

How BespokeFINANCE Works

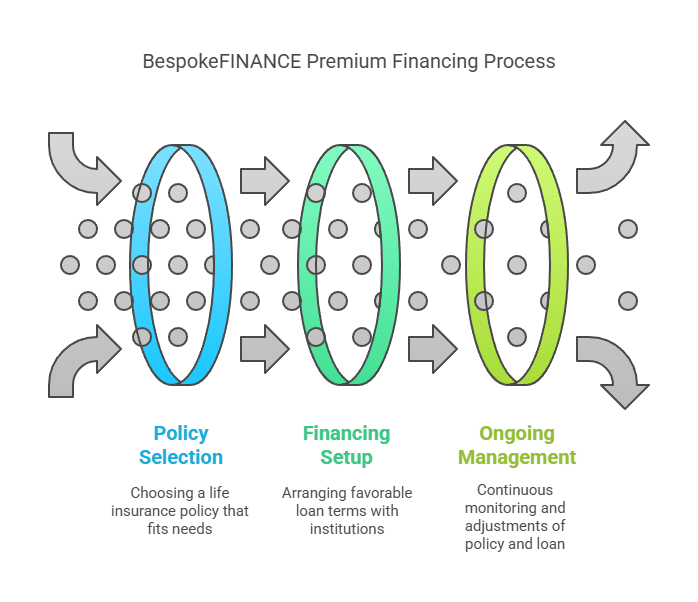

BespokeFINANCE is The Policy Shop’s tailored solution for premium financing. Here’s how it works:

- Assessment: We begin with a comprehensive analysis of your financial situation, long-term goals, and life insurance needs.

- Policy Selection: Based on your goals, we help you select a life insurance policy with the right balance of death benefit and cash value growth potential.

- Financing Setup: We work with top financial institutions to arrange the most favorable financing terms for your premium payments.

- Ongoing Management: Our team monitors your policy and the loan, making adjustments as needed to ensure the strategy remains aligned with your financial goals.

Case Study – Maximizing Legacy and Liquidity

Consider a high-net-worth individual who wants to maximize their legacy for future generations while maintaining liquidity for other investments. By utilizing BespokeFINANCE, they are able to secure a $10 million life insurance policy without diverting funds from their business or investment portfolio. The loan interest is serviced using other assets, and the policy’s cash value eventually grows to a point where it can support the repayment of the loan, creating a self-sustaining cycle of wealth accumulation.

Risks and Considerations

While premium financing offers significant benefits, it’s not without risks. The most notable risks include interest rate fluctuations, policy performance not meeting expectations, and the potential for margin calls if the value of the collateral (the life insurance policy) drops. At The Policy Shop, we mitigate these risks through careful planning, regular policy reviews, and working closely with our clients to ensure that the financing strategy remains viable over the long term.

Frequently Asked Questions

- What happens if I can’t repay the loan? The lender will typically use the life insurance policy’s cash value or death benefit to cover the outstanding loan amount.

- Is premium financing tax-efficient? Premium financing can be tax-efficient, particularly in estate planning, as the death benefit is generally income-tax-free to beneficiaries.

BespokeFINANCE is more than just a life insurance solution—it’s a comprehensive wealth management tool designed for those who want to maximize their financial potential without compromising on other investment opportunities. At The Policy Shop, we pride ourselves on providing personalized, expert guidance to help you navigate the complexities of premium financing and secure your legacy for future generations.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.