27 Jan Life Insurance: Navigating the Underwriting Process

Life Insurance Underwriting

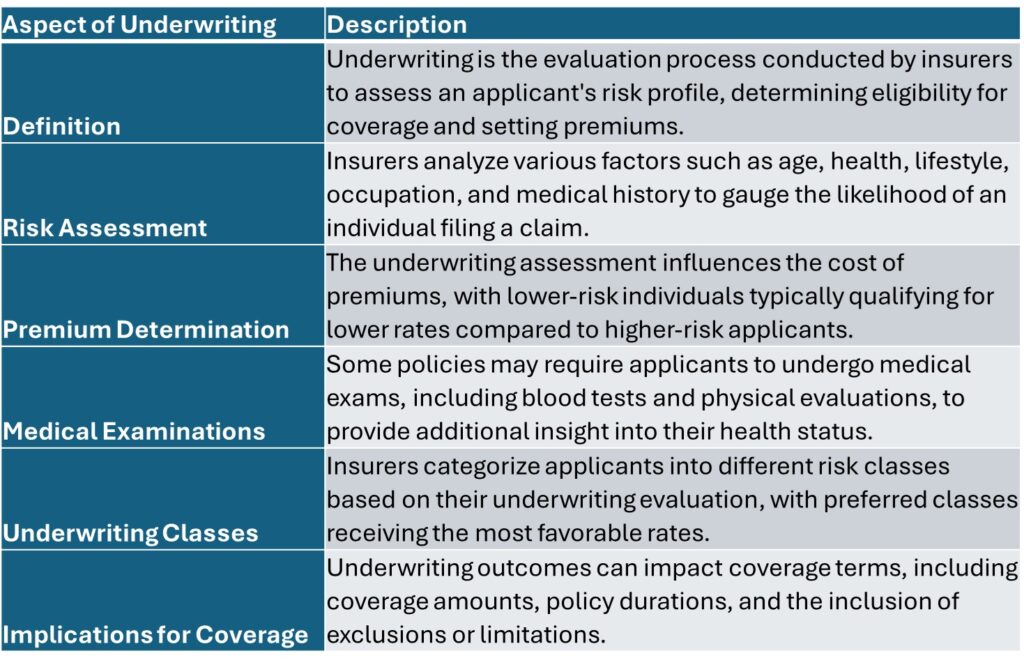

Underwriting is a critical aspect of the life insurance application process, shaping the terms and premiums of your policy. Understanding how underwriting works and its importance can empower individuals to navigate the process effectively and secure the most favorable coverage. This exploration delves into the intricacies of underwriting in life insurance, shedding light on its significance and implications for policyholders.

The Importance of Underwriting in Life Insurance

Underwriting Factors:

-

- Health History: Medical conditions, lifestyle habits, and family medical history impact insurability and premium rates.

- Age and Gender: Younger, healthier individuals typically receive lower premiums than older or higher-risk applicants.

- Occupation and Hobbies: Risky occupations or hobbies may result in higher premiums or coverage limitations.

Make informed decisions about your life insurance coverage:

Underwriting is a critical aspect of the life insurance application process, influencing your eligibility and premium rates. By understanding how underwriting works and the factors that impact your insurability, you can navigate the application process with confidence.

Whether you’re in excellent health or have pre-existing conditions, there’s a life insurance solution to meet your needs. Explore the importance of underwriting and ensure you’re getting the coverage that’s right for you and your loved ones.

The underwriting process serves as the backbone of life insurance, enabling insurers to assess risk and determine appropriate coverage and premiums for policyholders. By understanding how underwriting works and its significance, individuals can proactively manage their risk profile to secure favorable coverage terms and rates. From providing detailed medical histories to adopting healthy lifestyle choices, applicants can positively influence their underwriting outcomes and optimize their insurance protection. With transparency and insight into the underwriting process, individuals can make informed decisions that align with their financial goals and protection needs, ensuring peace of mind for themselves and their loved ones.

Contact us today to begin your journey toward securing your legacy with The Policy Shop. Together, we’ll create a brighter tomorrow for you and your loved ones.