04 Feb Permanent Life Insurance: Benefits

Permanent life insurance offers a range of benefits beyond basic financial protection, making it a valuable asset in long-term financial planning. Let’s delve into the advantages of permanent life insurance and how it can serve as a cornerstone of your financial strategy.

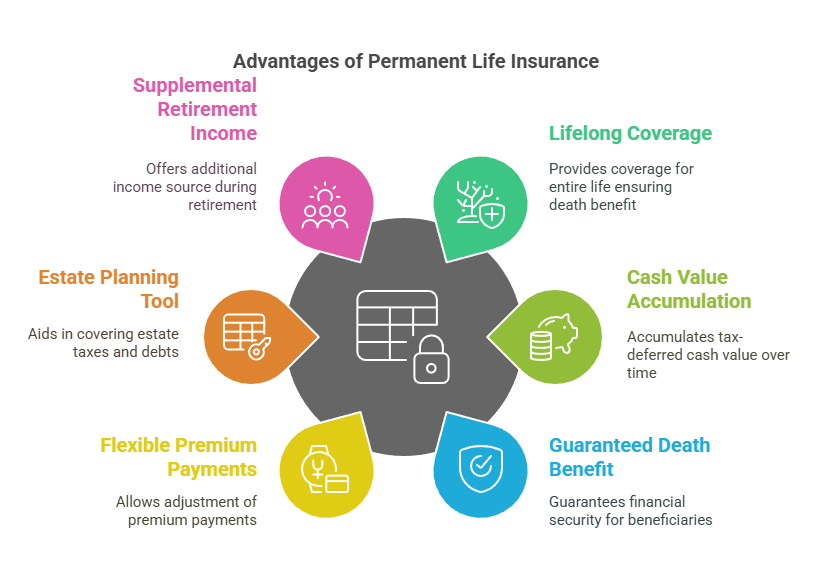

Advantages of Permanent Life Insurance:

- Lifelong Coverage: Unlike term life insurance, permanent life insurance provides coverage for your entire life, ensuring that your beneficiaries receive a death benefit whenever you pass away.

- Cash Value Accumulation: Permanent life insurance policies accumulate cash value over time, which grows tax-deferred and can be accessed during your lifetime for various financial needs.

- Guaranteed Death Benefit: Permanent life insurance guarantees a death benefit payout to your beneficiaries, providing financial security and peace of mind for your loved ones.

- Flexibility in Premium Payments: Many permanent life insurance policies offer flexibility in premium payments, allowing you to adjust the frequency and amount of premium payments based on your financial circumstances.

- Estate Planning Tool: Permanent life insurance can play a crucial role in estate planning by providing liquidity to cover estate taxes, pay off debts, and ensure an equitable distribution of assets to heirs.

- Supplemental Retirement Income: The cash value accumulated in a permanent life insurance policy can serve as a source of supplemental retirement income, providing financial stability during your golden years.

Types of Permanent Life Insurance:

- Whole Life Insurance: Offers fixed premiums, guaranteed cash value growth, and lifelong coverage.

- Universal Life Insurance: Provides flexibility in premium payments and death benefit options, allowing policyholders to adjust coverage as needed.

- Variable Life Insurance: Combines life insurance coverage with investment options, offering the potential for higher returns but also greater investment risk.

Permanent life insurance offers a range of benefits that extend beyond basic financial protection, making it a versatile tool for long-term financial planning. By understanding the advantages of permanent life insurance and exploring the various policy options available, you can create a comprehensive financial strategy that provides security and peace of mind for you and your loved ones.

Explore our selection of permanent life insurance policies tailored to meet your individual needs and financial goals.

Contact The Policy Shop today to schedule your personalized consultation and take the first step towards securing your financial future.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.