03 Feb Planning for Life’s Milestones: Using Insurance Solutions for Major Life Events

Life Insurance for Major Life Events

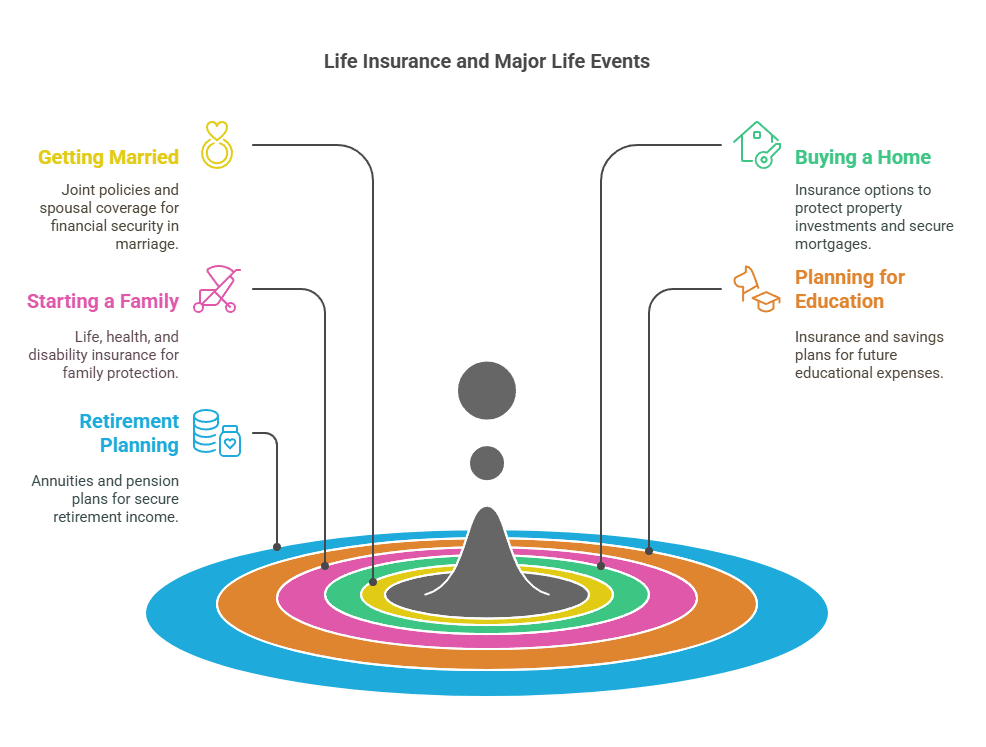

In this informative article, we explore how insurance solutions can be used to navigate major life events and secure your financial future. From getting married to buying a home to starting a family, discover how insurance can provide protection and peace of mind during life’s most significant milestones.

Key Sections:

-

Getting Married:

- Financial Planning: Getting married is a significant life event that often prompts couples to reevaluate their financial plans and goals. Insurance can play a crucial role in this process by providing protection and financial security for both spouses.

- Joint Life Insurance Policies: Couples may consider purchasing joint life insurance policies to ensure that both spouses are adequately protected in the event of one partner’s passing. These policies can provide a lump-sum benefit to the surviving spouse, helping to cover living expenses, debts, and other financial obligations.

- Spousal Coverage Options: Married couples may also explore spousal coverage options offered through employer-sponsored insurance plans or individual policies. These options can provide additional coverage for spouses who may not have access to employer-sponsored benefits.

- Combining Finances and Assets: Insurance can help couples protect their combined finances and assets by providing coverage for shared debts, such as a mortgage or car loan, as well as individual assets, such as savings accounts or investment portfolios. By incorporating insurance into their financial planning, couples can ensure that they are adequately protected against unexpected events.

-

Buying a Home:

- Protection for Investments: Buying a home is one of the most significant investments that individuals and couples make in their lifetime. Insurance can help protect this investment by providing coverage for property damage, liability claims, and other risks associated with homeownership.

- Mortgage Insurance: Mortgage insurance, such as private mortgage insurance (PMI) or mortgage protection insurance, can provide financial protection for homeowners who are unable to make their mortgage payments due to unemployment, disability, or death.

- Homeowners Insurance: Homeowners insurance is essential for protecting against property damage and liability claims. This type of insurance typically covers damage caused by fire, theft, vandalism, and natural disasters, as well as liability claims arising from accidents on the property.

- Coverage Options: Homeowners may also consider additional coverage options, such as flood insurance or earthquake insurance, depending on their location and specific risks. By carefully evaluating their insurance needs and selecting the appropriate coverage options, homeowners can ensure that their investment is adequately protected against unforeseen events.

-

Starting a Family:

- Importance of Insurance: Starting a family is a significant life event that often prompts individuals to reassess their insurance needs and priorities. Insurance can provide essential protection and financial security for growing families, ensuring that loved ones are provided for in the event of a parent’s passing or disability.

- Life Insurance: Life insurance is a critical component of financial planning for families, as it can provide a source of income replacement and financial support for surviving family members. Term life insurance policies are often recommended for young families due to their affordability and flexibility.

- Health Insurance: Health insurance is essential for covering medical expenses and ensuring access to quality healthcare for family members. Families may obtain health insurance coverage through employer-sponsored plans, individual policies, or government programs such as Medicaid or the Children’s Health Insurance Program (CHIP).

- Disability Insurance: Disability insurance can provide income replacement if a primary breadwinner is unable to work due to illness or injury. This type of insurance can help families maintain their standard of living and meet their financial obligations during difficult times.

-

Planning for Education Expenses:

- Saving for Education: Planning for education expenses is a crucial aspect of financial planning for families with children. Insurance can play a role in this process by providing a vehicle for saving and investing for future educational costs.

- Education Savings Plans: Families may consider education savings plans, such as 529 college savings plans or Coverdell Education Savings Accounts (ESAs), to save for their children’s education expenses. These plans offer tax advantages and investment flexibility, making them attractive options for families seeking to save for college.

- Whole Life Insurance Policies: Whole life insurance policies can also serve as a vehicle for saving for education expenses. These policies offer a combination of death benefit protection and cash value accumulation, which can be accessed tax-free to fund college tuition and other educational costs.

- Annuities: Annuities are another option for saving for education expenses, offering guaranteed income streams and tax-deferred growth potential. Families may consider annuities as part of their overall education savings strategy to supplement other savings and investment vehicles.

-

Retirement Planning:

- Importance of Retirement Planning: Planning for retirement is a critical aspect of financial planning for individuals and couples. Insurance can play a role in this process by providing retirement income solutions and ensuring financial security in retirement.

- Annuities: Annuities are insurance products that offer guaranteed income streams for life or a specified period, making them a popular choice for retirement planning. Fixed annuities provide predictable income payments, while variable annuities offer the potential for investment growth and income growth.

- Pension Plans: Pension plans are employer-sponsored retirement plans that provide a stream of income to retirees based on their years of service and salary history. Defined benefit pension plans offer guaranteed income for life, while defined contribution plans, such as 401(k) plans, allow employees to contribute to their retirement savings through pre-tax or after-tax contributions.

- Other Retirement Savings Vehicles: In addition to annuities and pension plans, individuals and couples may use other retirement savings vehicles, such as individual retirement accounts (IRAs) and employer-sponsored retirement plans, to save for retirement. These savings vehicles offer tax advantages and investment flexibility, allowing individuals to accumulate wealth and generate income in retirement.

Conclusion:

Insurance solutions offer valuable protection and peace of mind during life’s major milestones. By understanding how insurance can be used to navigate events such as marriage, homeownership, starting a family, education expenses, and retirement planning, you can secure your financial future and enjoy greater peace of mind. Contact The Policy Shop today to explore your insurance options and take proactive steps towards securing your future.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.