10 Sep Estate Planning with Life Insurance: Preserving Your Legacy

Estate Planning with Life Insurance

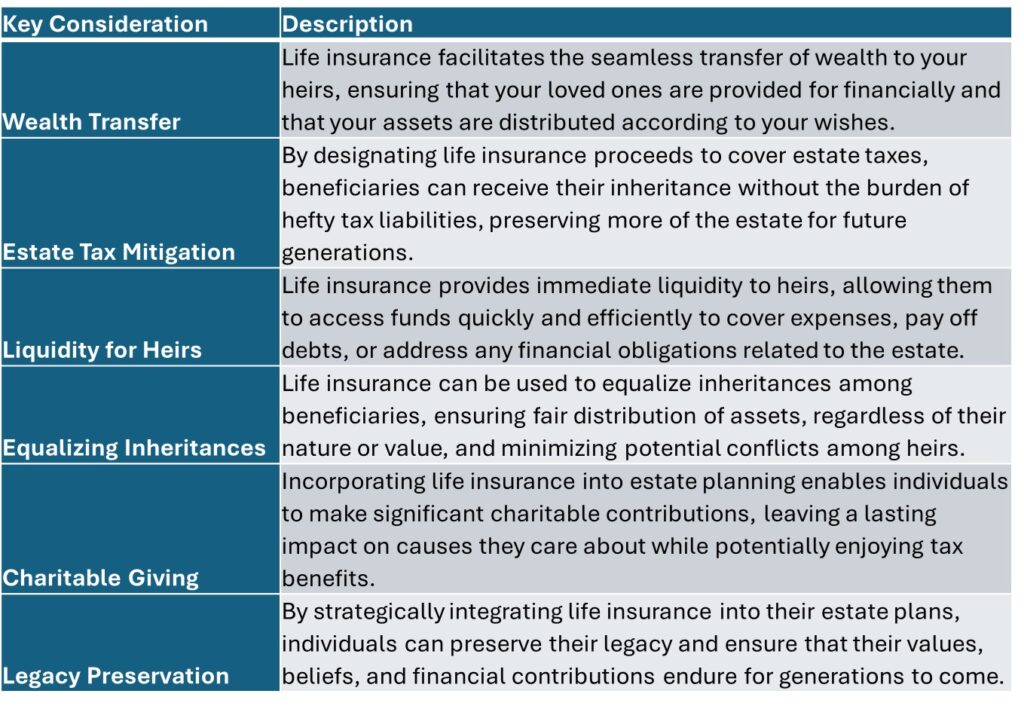

Estate planning is a crucial aspect of financial management, especially for individuals looking to preserve their wealth and assets for future generations. While many strategies exist, life insurance stands out as a powerful tool, offering a range of benefits that can help secure and enhance your legacy. In this article, we delve into the role of life insurance in estate planning and how it can ensure the smooth transfer of assets while minimizing tax liabilities for your heirs.

Preserving Your Legacy:

- Wealth Preservation: Life insurance can help cover estate taxes and other expenses, preserving your assets for future generations.

- Probate Avoidance: Life insurance proceeds pass directly to beneficiaries outside of probate, expediting the distribution process.

- Equal Inheritance: Life insurance allows you to provide for loved ones who may not receive assets directly from your estate, ensuring fair distribution.

Secure your legacy and mitigate tax implications:

Life insurance is a valuable tool for estate planning, enabling you to safeguard your assets and provide for your heirs. By incorporating life insurance into your estate plan, you can ensure that your loved ones are taken care of financially and that your legacy endures. Whether you’re concerned about estate taxes, probate delays, or equal distribution among beneficiaries, life insurance offers solutions to address these challenges. Explore estate planning strategies with life insurance and protect your family’s financial future.

Estate planning is a critical component of comprehensive financial management, particularly for those seeking to preserve their wealth and legacy for future generations. Life insurance offers a range of benefits that can enhance estate planning strategies, from facilitating wealth transfer and minimizing tax liabilities to providing liquidity for heirs and preserving legacies.

By exploring the role of life insurance and understanding its potential impact on wealth preservation, individuals can take proactive steps to safeguard their assets and ensure their financial legacy endures for generations to come.

Contact us today to begin your journey toward securing your legacy with The Policy Shop. Together, we’ll create a brighter tomorrow for you and your loved ones.