03 Feb 8 Common Questions About Indexed Universal Life Insurance (IUL)

Common Questions About Indexed Universal Life Insurance (IUL)

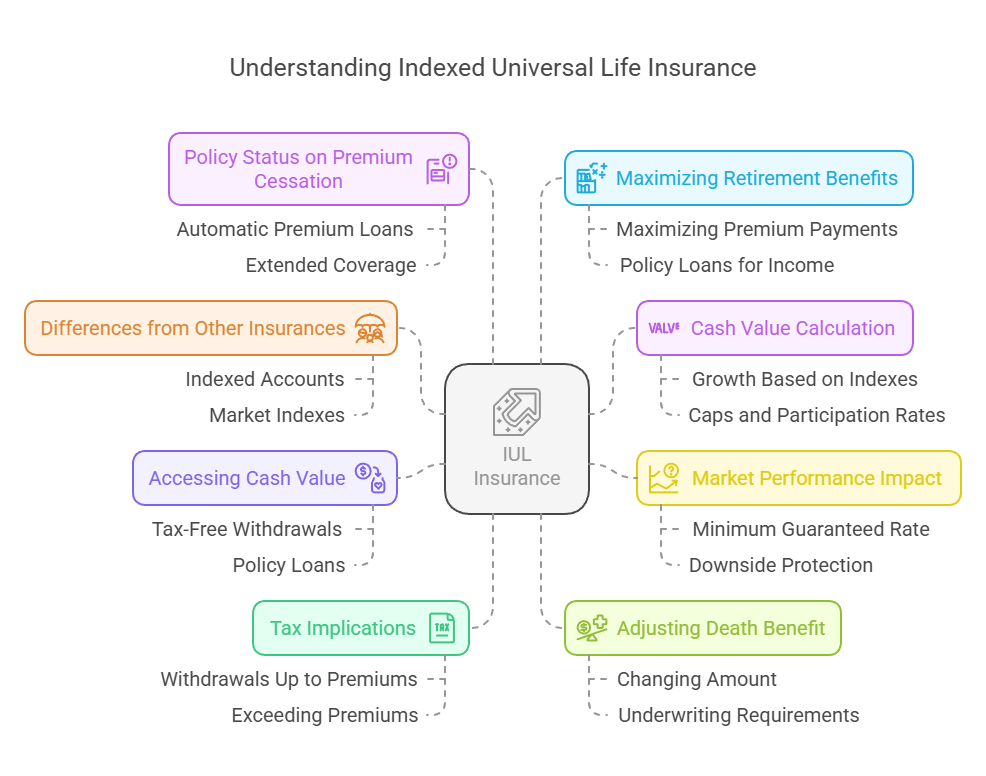

Indexed Universal Life (IUL) insurance can be complex, leading to questions and misconceptions about how it works. Let’s address eight common questions about IUL insurance to provide clarity and help you make informed decisions about your financial future.

Question: How does Indexed Universal Life insurance differ from other types of life insurance?

Answer: Unlike traditional life insurance policies, Indexed Universal Life insurance allows policyholders to allocate cash value into indexed accounts tied to market indexes, offering potential for higher returns.

Question: How is the cash value in an IUL policy calculated?

Answer: The cash value in an IUL policy is calculated based on the performance of selected market indexes. As the indexes grow, so does the cash value, subject to certain caps and participation rates.

Question: What happens if the market index linked to an IUL policy performs poorly?

Answer: In the event of poor market performance, the policy’s cash value will not decrease below the minimum guaranteed interest rate, providing downside protection for the policyholder.

Question: Can I access the cash value in my IUL policy before retirement?

Answer: Yes, policyholders can access the cash value in an IUL policy through tax-free withdrawals or policy loans, providing flexibility for various financial needs.

Question: Are there tax implications associated with withdrawals from an IUL policy?

Answer: Withdrawals from an IUL policy are typically tax-free up to the amount of premiums paid. However, withdrawals exceeding premiums may be subject to income tax and potential penalties.

Question: Can I change the death benefit amount in my IUL policy?

Answer: Yes, policyholders can adjust the death benefit amount in an IUL policy to meet changing financial needs, subject to certain limitations and underwriting requirements.

Question: What happens to my IUL policy if I stop making premium payments?

Answer: If premium payments cease, the policy’s cash value can be used to cover future premiums through automatic premium loans or extended coverage options, ensuring the policy remains in force.

Question: How can I maximize the benefits of an IUL policy for retirement planning?

Answer: To maximize the benefits of an IUL policy for retirement planning, consider maximizing premium payments, utilizing policy loans for supplemental retirement income, and exploring additional retirement income options available through the policy.

Conclusion:

Have more questions about Indexed Universal Life insurance? Contact The Policy Shop to speak with an expert and get the answers you need to make informed decisions about your financial future.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.