03 Feb Life Insurance Options: Choosing the Right Coverage

Life Insurance: Choosing the Right Coverage

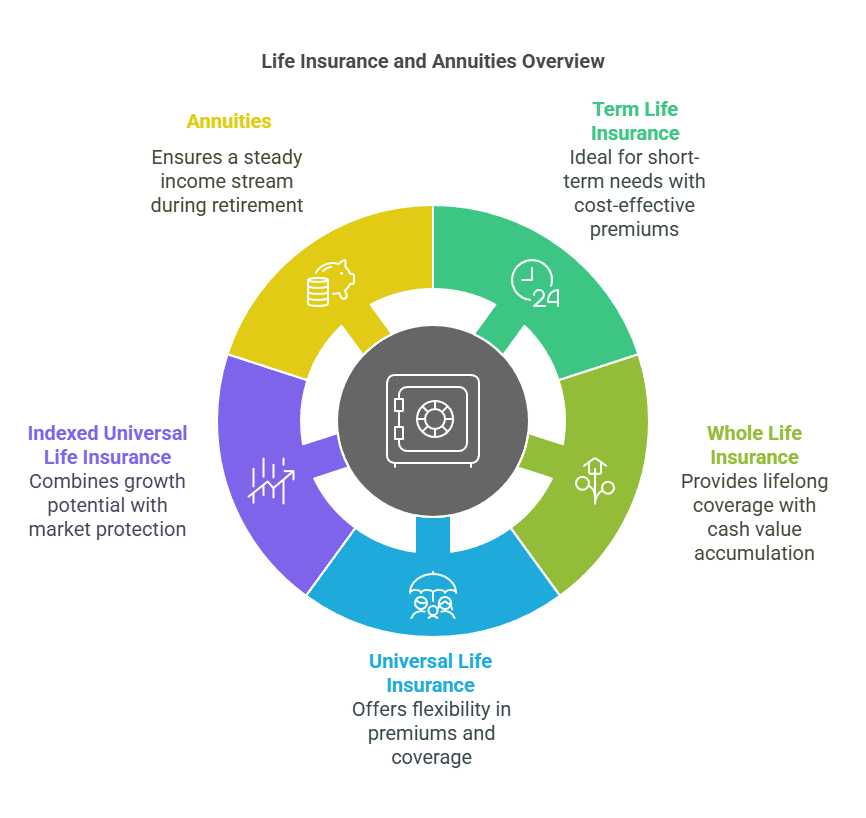

Life insurance serves as a crucial financial tool, providing peace of mind and security for you and your loved ones. With various options available, it’s essential to understand the different types of life insurance and their benefits to make an informed decision. Additionally, annuities, often considered part of retirement planning, offer a unique approach to securing your financial future. Let’s explore each type and their advantages:

-

Term Life Insurance:

Description: Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers straightforward protection at an affordable price, making it an excellent option for those with temporary needs.

Best Candidate: Young families, individuals with outstanding debts or mortgages, or those seeking affordable coverage.

Benefits:

Cost-effective premiums.

Simple and easy to understand.

Provides financial protection during critical life stages.

Ideal for covering short-term needs such as mortgage or education expenses.

-

Whole Life Insurance:

Description: Whole life insurance offers lifelong coverage with guaranteed premiums and a cash value component that accumulates over time. It provides permanent protection and a source of savings.

Best Candidate: Individuals seeking long-term financial security and wealth accumulation.

Benefits:

Lifetime coverage with guaranteed premiums.

Cash value accumulation that grows tax-deferred.

Ability to borrow against the cash value.

Policyholder dividends (with participating policies) that can enhance the policy’s value.

-

Universal Life Insurance:

Description: Universal life insurance offers flexible premiums and death benefits, allowing policyholders to adjust coverage and payments based on their changing needs. It combines life insurance protection with a cash value component.

Best Candidate: Those seeking flexibility in premium payments and death benefits.

Benefits:

Flexibility to adjust premiums and coverage.

Cash value accumulation with potential for growth.

Option to access cash value through loans or withdrawals.

Ability to customize the policy to meet specific financial goals.

-

Indexed Universal Life Insurance (IUL):

Description: Indexed universal life insurance offers flexible premiums and death benefits, with cash value growth tied to the performance of stock market indices. It provides potential for higher returns while protecting against market downturns.

Best Candidate: Individuals seeking growth potential with downside protection.

Benefits:

Potential for higher returns compared to traditional universal life insurance.

Downside protection against market losses.

Flexibility to adjust premiums and coverage.

Tax-deferred cash value accumulation.

-

Annuities:

Description: Annuities are financial products designed to provide a steady stream of income during retirement. They come in various forms, including immediate annuities, deferred annuities, and fixed-indexed annuities.

Best Candidate: Individuals planning for retirement or seeking guaranteed income.

Benefits:

Guaranteed income for life with immediate annuities.

Tax-deferred growth of investment earnings.

Flexibility to choose between fixed or variable payouts.

Option to include death benefits for beneficiaries.

In conclusion, selecting the right life insurance policy or annuity depends on your unique financial situation and goals. At The Policy Shop, we understand the importance of finding the perfect coverage tailored to your needs. Our team of experts is here to guide you through the process and craft a personalized policy that provides the protection and peace of mind you deserve. Contact us today to begin your journey towards financial security.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.