03 Feb Unlocking College Funding Potential with CollegePLUS IUL Insurance

College Funding with Indexed Universal Life (IUL) insurance

CollegePLUS Indexed Universal Life (IUL) insurance, offered by The Policy Shop, is a specialized financial tool designed to provide families with an innovative strategy for funding their child’s college education. But what exactly is CollegePLUS IUL?

At its core, CollegePLUS IUL is a tax advantaged cash-value life insurance product that offers the dual benefits of traditional life insurance coverage and potential growth tied to specific market indexes. Premiums are allocated to market driven indexed accounts, such as the S&P 500. As the market performs well, the cash value of the policy has the potential to grow, serving as a valuable source of funds for college expenses. Unique to CollegePLUS is the downside protection, meaning if the market has a negative return, you won’t lose any of your principal or accumulated interest. This Market driven returns and downside protection offers the best of both worlds.

Consider the following hypothetical scenario:

Parent: Meet Steve and Lina, a young couple with a newborn son named Charles. Concerned about James’s future, they opt to secure his financial well-being by investing in a CollegePLUS IUL policy.

Policy: The policy offers a death benefit of $100,000 and a cash value growth potential with historical returns above 10% annually. Steve and Lina make premium payments, witnessing steady growth in the policy’s cash value over time.

Outcome: Fast forward to Charles’s 18th birthday. Thanks to the cash value accumulated in his CollegePLUS IUL policy, he has ample funds to cover his college tuition and even kickstart his entrepreneurial dreams.

When is the ideal time to consider purchasing CollegePLUS IUL insurance?

CollegePLUS IUL insurance is particularly beneficial for parents aiming to secure their child’s financial future, specifically focusing on college funding. Here are some instances where CollegePLUS IUL could be advantageous:

- Providing a Death Benefit: Parents seeking to provide a safety net for their child’s family in the event of their untimely demise can benefit from the death benefit offered by CollegePLUS IUL.

- Saving for College: The cash value accumulated in a CollegePLUS IUL policy can be utilized to cover college expenses, ensuring a tax-efficient way to fund higher education.

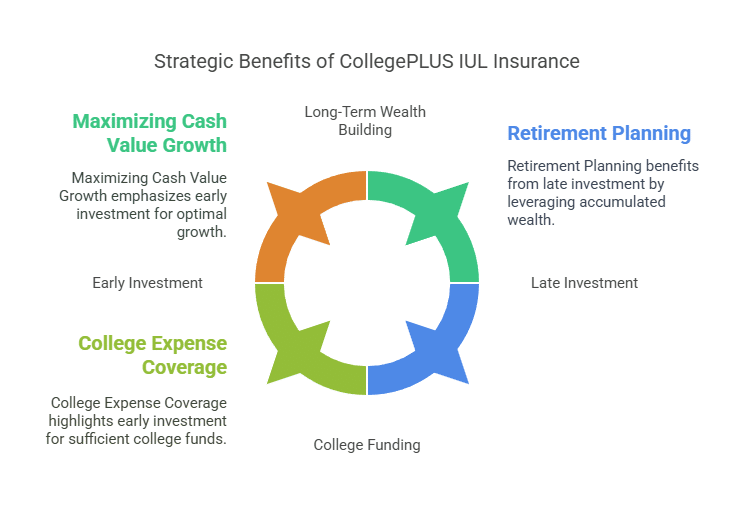

- Building Long-Term Wealth: Beyond college funding, the cash value of a CollegePLUS IUL policy has the potential to grow over time, offering a valuable asset for retirement planning or other financial objectives.

Why Start Early?

Timing is key when it comes to purchasing CollegePLUS IUL insurance for your child. Here’s why starting early is advantageous:

- Lower Premiums: Younger applicants typically qualify for lower premiums, making it a cost-effective solution for securing their financial future.

- Maximizing Cash Value Growth: Starting early allows for more time to accumulate cash value, maximizing the benefits over the policy’s lifetime.

- Locking in Favorable Rates: Purchasing CollegePLUS IUL insurance early ensures favorable rates and coverage.

Don’t wait to secure your child’s financial future. Explore the benefits of CollegePLUS IUL insurance from The Policy Shop today and start the process towards funding your child’s college education with confidence!

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.