27 Jan Tax Savings: The Benefits of Life Insurance

Benefits of Life Insurance

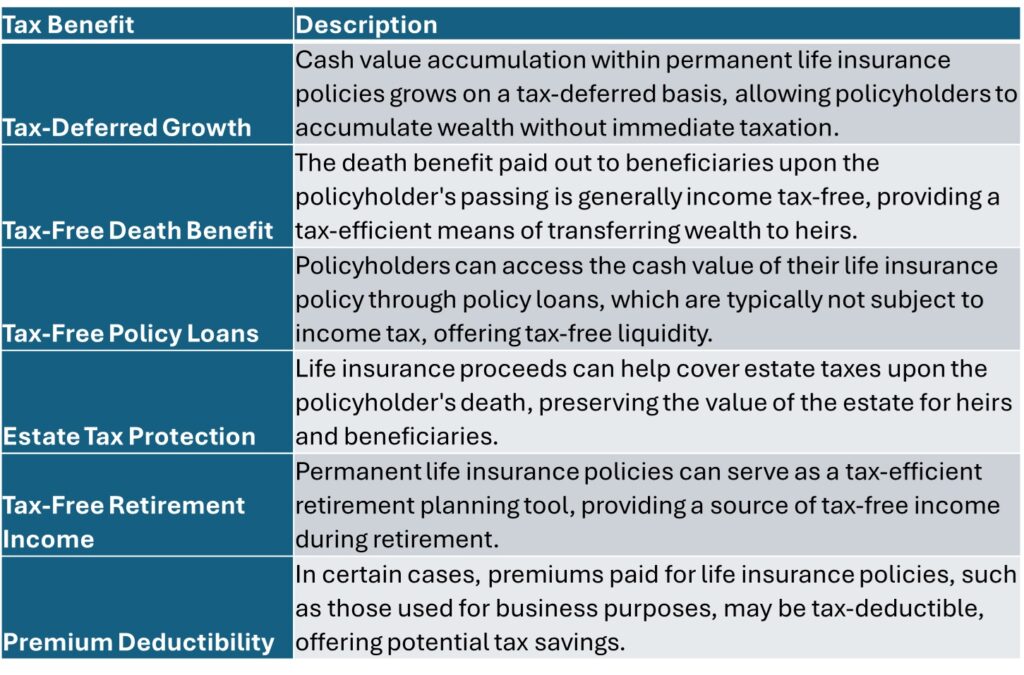

Life insurance offers more than just financial protection; it can also provide valuable tax benefits that can help individuals maximize their savings and minimize their tax liabilities. Understanding the tax advantages associated with life insurance policies is essential for optimizing your financial strategy and building a secure future. In this exploration, we delve into the various tax benefits of life insurance and how you can leverage them to enhance your financial well-being.

Tax Benefits of Life Insurance: Maximizing Your Savings

Tax-Advantaged Features:

-

- Death Benefit: Life insurance proceeds are generally tax-free to beneficiaries, providing financial support without incurring income tax.

- Cash Value Growth: Cash value accumulates on a tax-deferred basis, allowing for potential tax savings over time.

- Policy Loans: Loans from cash value are typically tax-free and can be used to supplement income or cover expenses without triggering taxable events.

Maximize your savings while protecting your loved ones:

Life insurance offers numerous tax advantages that can help you save money and provide financial security for your family. By understanding the tax benefits associated with life insurance policies, you can leverage them to your advantage and optimize your financial strategy.

Whether you’re concerned about estate taxes, income taxes, or capital gains taxes, life insurance offers solutions to minimize tax liability and maximize savings. Explore the tax benefits of life insurance and take proactive steps to protect your assets and loved ones.

Life insurance policies offer a range of tax benefits that can help individuals optimize their financial strategy and achieve their long-term goals. From tax-deferred growth and tax-free death benefits to estate tax protection and tax-free retirement income, these advantages provide valuable opportunities for savings and wealth preservation. By leveraging the tax benefits of life insurance, individuals can build a comprehensive financial plan that enhances their financial security and provides for their loved ones’ future needs. With careful planning and strategic use of life insurance, individuals can maximize their savings, minimize their tax liabilities, and create a legacy of financial stability for generations to come.

Contact us today to begin your journey toward securing your legacy with The Policy Shop. Together, we’ll create a brighter tomorrow for you and your loved ones.