27 Jan Navigating Life Insurance: Solutions for Common Concerns

Life Insurance: Solutions for Common Concerns

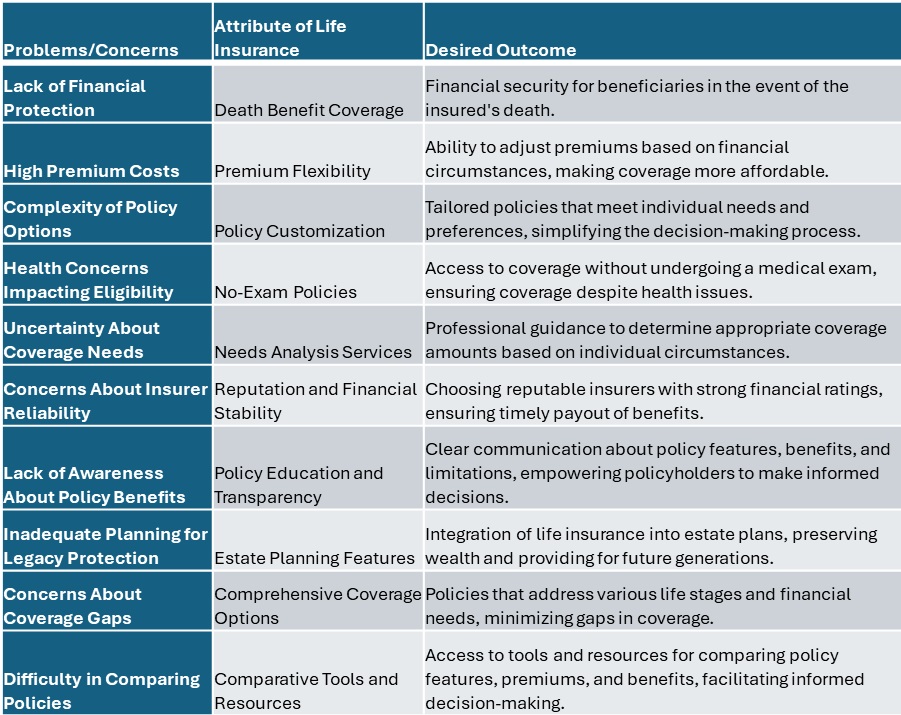

Life insurance is a fundamental tool for protecting your loved ones and securing your financial legacy. However, navigating the complexities of the life insurance industry can be daunting, with various concerns and considerations to address. In this grid, we’ll explore common problems and concerns in the life insurance industry, along with how life insurance can provide solutions and desired outcomes for individuals seeking financial protection and peace of mind.

Life insurance stands as a cornerstone of financial planning, offering a crucial layer of protection for individuals and their families. In an uncertain world, life insurance provides a vital safety net, ensuring that loved ones are safeguarded and financial obligations are met, even in the face of unexpected events.

life insurance premiums

One of the primary concerns individuals may have when considering life insurance is the cost of premiums. However, with the right policy and guidance, individuals can find coverage that fits within their budget while providing adequate protection for their loved ones. By exploring different policy options and understanding how premiums are determined, individuals can make informed decisions that balance their financial needs with their long-term goals.

coverage gaps

Another common concern is the potential for coverage gaps, where policyholders may find themselves underinsured or without sufficient protection. However, with the guidance of experienced insurance professionals, individuals can assess their coverage needs and select policies that provide comprehensive protection against a range of potential risks. From term life insurance to permanent policies, there are options available to suit every stage of life and financial situation.

life insurance coverage

Health-related issues can also be a source of concern when it comes to obtaining life insurance coverage. However, many insurance providers offer policies that accommodate individuals with pre-existing conditions or other health concerns. By working with knowledgeable agents and exploring different policy options, individuals can find coverage that meets their needs while providing peace of mind for themselves and their loved ones.

terms and conditions of coverage

Transparency is key when it comes to life insurance policies, and individuals should feel confident that they understand the terms and conditions of their coverage. With transparent policies and clear communication from insurance providers, individuals can make informed decisions about their coverage and feel secure in their financial planning efforts.

tailored coverage

Customizable options further enhance the appeal of life insurance, allowing individuals to tailor their coverage to their unique needs and circumstances. Whether it’s adjusting coverage amounts, adding riders for additional protection, or exploring investment-linked policies, there are options available to suit a variety of preferences and objectives.

At The Policy Shop, we understand the importance of life insurance as a tool for financial security and peace of mind. Our team of experienced professionals is dedicated to helping individuals navigate the complexities of life insurance, providing expert guidance and personalized solutions to meet their unique needs and goals. With our support, individuals can plan for the future with confidence, knowing that their loved ones will be protected and their financial legacy preserved

Contact us today to begin your journey toward securing your legacy with The Policy Shop. Together, we’ll create a brighter tomorrow for you and your loved ones.