03 Feb What Types of Life Insurance Are Available?

Types of Life Insurance

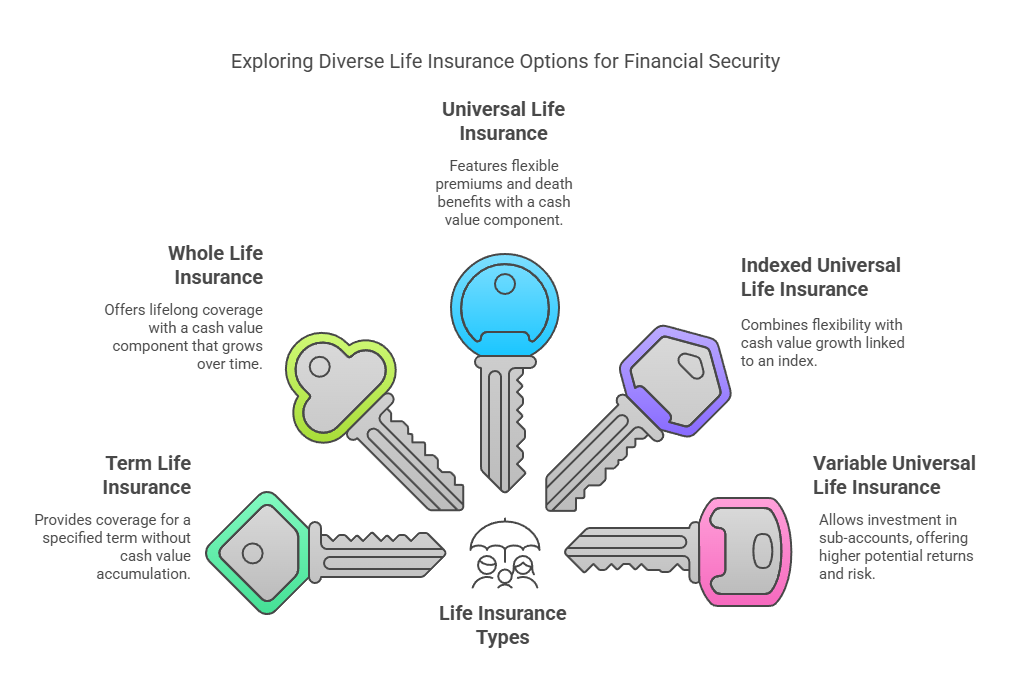

Life insurance comes in various forms, each offering different features and benefits. Let’s explore the different types of life insurance policies available to help you choose the right one for your needs.

Answer: The main types of life insurance include:

- Term Life Insurance: Provides coverage for a specified term, typically 10, 20, or 30 years. It offers a death benefit but does not accumulate cash value.

- Whole Life Insurance: Provides coverage for your entire life and includes a cash value component that grows over time. Premiums are typically higher than term life insurance.

- Universal Life Insurance: Offers flexibility in premium payments and death benefits, as well as a cash value component that earns interest over time.

- Indexed Universal Life Insurance (IUL): Combines the flexibility of universal life insurance with the potential for cash value growth linked to the performance of an underlying index, such as the S&P 500.

- Variable Universal Life Insurance: Allows policyholders to invest their cash value in sub-accounts similar to mutual funds, with the potential for higher returns but also higher risk.

Example: For example, if James wants coverage for a specific period, such as until his mortgage is paid off, he might opt for a term life insurance policy. On the other hand, if Susan is looking for lifelong coverage with an investment component, she might consider whole life or universal life insurance.

Conclusion:

Understanding the different types of life insurance policies can help you make an informed decision based on your financial goals and needs.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.