04 Feb Building Wealth with Indexed Universal Life Insurance (IUL) | WealthX IUL

Building Wealth with Indexed Universal Life Insurance

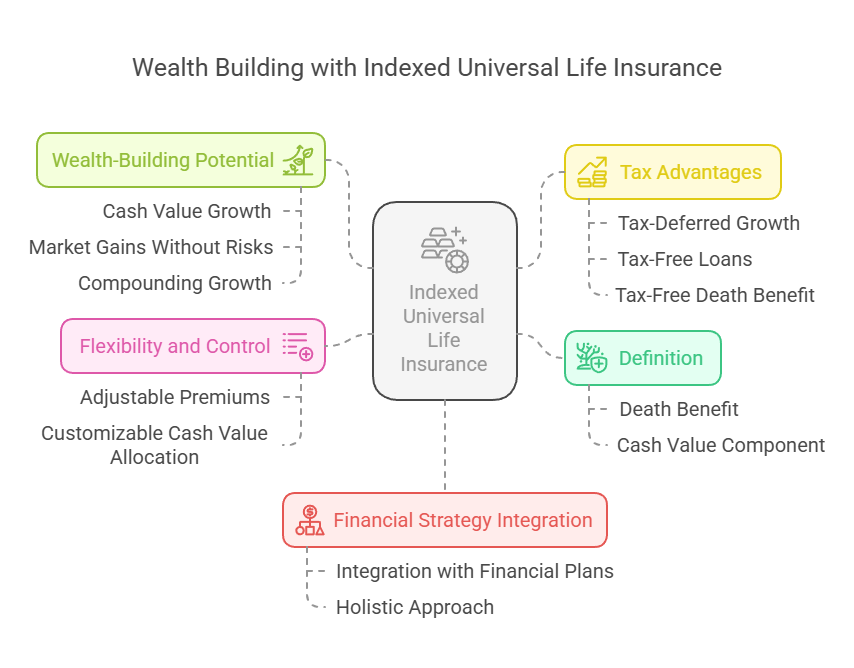

Indexed Universal Life Insurance (IUL) is more than just a life insurance policy—it’s a powerful financial tool that can help you build wealth over time while providing essential life insurance coverage. If you’ve ever wondered how to balance the need for life insurance with the desire to grow your wealth, IUL might be the perfect solution. This guide (Building Wealth with Indexed Universal Life Insurance) will walk you through everything you need to know about IUL, from how it works to its key benefits, and how you can use it as a cornerstone of your wealth-building strategy.

What Is Indexed Universal Life Insurance (IUL)?

IUL is a type of permanent life insurance that not only offers a death benefit to your beneficiaries but also accumulates cash value over time. Unlike traditional life insurance, the cash value in an IUL policy is tied to a stock market index, such as the S&P 500. This means your cash value has the potential to grow based on market performance, while also being protected from market downturns through a guaranteed minimum interest rate.

How IUL Helps You Build Wealth

One of the most attractive features of IUL is its wealth-building potential. As the cash value grows, it can be accessed tax-free through policy loans or withdrawals, providing a source of income that can be used for retirement, education, or other financial goals. Additionally, because the growth is tied to a market index, you can benefit from the upside of market gains without the downside risk. Over time, the compounding growth of the cash value can significantly contribute to your overall wealth.

Tax Advantages of IUL

IUL policies offer several tax advantages that make them appealing for wealth building. The cash value grows on a tax-deferred basis, meaning you won’t pay taxes on the gains as they accumulate. When you take out a policy loan, it’s typically tax-free, and the death benefit is usually paid out to your beneficiaries tax-free as well. These tax benefits can help you maximize the amount of wealth you can pass on to your loved ones.

Flexibility and Control with IUL

Another key benefit of IUL is the flexibility it offers. You can adjust your premium payments and death benefit as your financial situation changes, making it easier to adapt the policy to your evolving needs. Additionally, you have control over how the cash value is allocated among different index options, allowing you to tailor the policy to your risk tolerance and financial goals.

Using IUL in Your Financial Strategy

To effectively use IUL as part of your wealth-building strategy, it’s important to integrate it with your overall financial plan. Consider how IUL fits with your retirement accounts, investment portfolios, and other insurance policies. By taking a holistic approach, you can ensure that your IUL policy complements your other financial tools and helps you achieve your long-term goals.

Indexed Universal Life Insurance is more than just a safety net—it’s a dynamic financial instrument that can help you build wealth while providing valuable life insurance coverage. With its unique combination of growth potential, tax advantages, and flexibility, IUL offers a compelling way to enhance your financial strategy. Whether you’re just starting to build wealth or looking for a way to protect and grow your assets, IUL could be the key to securing your financial future.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.