04 Feb Choosing Between Fixed, Variable, and Indexed Annuities for Your Financial Goals

Fixed, Variable, and Indexed Annuities

Navigating the world of annuities can feel like trying to solve a complex puzzle, but it doesn’t have to be overwhelming. Fixed, variable, and indexed annuities each offer unique benefits, and finding the right fit for your financial goals is crucial. Whether you’re looking for stability, growth, or a mix of both, this guide will help you understand the differences and choose the best annuity for your needs. (Fixed, Variable, and Indexed Annuities)

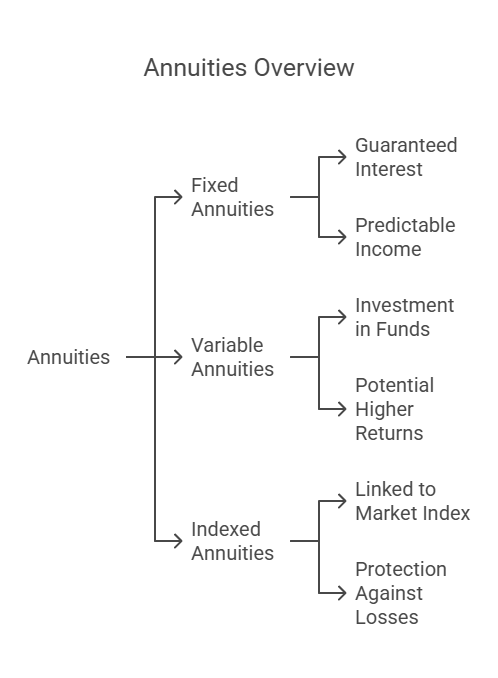

Overview of Annuities:

Annuities are financial products designed to provide regular income, typically for retirement. They come in various flavors, each with its own set of features. Understanding these can help you make informed decisions about your financial future.

Fixed Annuities:

- What They Are: Fixed annuities offer guaranteed interest rates and fixed payments for a set period or for life.

- Benefits: Predictable income and safety from market fluctuations. Ideal for conservative investors who want a reliable income stream.

Variable Annuities:

- What They Are: Variable annuities allow you to invest in a range of funds, with returns dependent on the performance of these investments.

- Benefits: Potential for higher returns, but with increased risk. Best for those who are comfortable with investment risk and want growth potential.

Indexed Annuities:

- What They Are: Indexed annuities offer returns linked to a stock market index (like the S&P 500), with built-in protection against market losses.

- Benefits: Growth potential tied to market performance, with a floor to protect against losses. Great for those who want to balance risk and reward.

Choosing the Right Annuity:

- Factors to Consider: Assess your risk tolerance, income needs, and investment goals. Fixed annuities are best for guaranteed income, variable for growth potential, and indexed for a mix of both.

- Integration with Other Financial Tools: Combine annuities with other investments, including life insurance, to create a comprehensive financial plan.

Case Studies and Practical Examples:

Meet Lisa, who chose a fixed annuity for steady retirement income, and Tom, who opted for an indexed annuity to enjoy market-linked growth with downside protection. Their choices reflect how different annuities can meet varied financial needs.

Choosing between fixed, variable, and indexed annuities depends on your personal financial goals and risk tolerance. Each type offers unique advantages, and understanding these can help you make a choice that enhances your financial security. Ready to find the perfect annuity for you? Connect with The Policy Shop to explore your options!

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.