04 Feb 5 Financial Mistakes to Avoid When Planning for Retirement

Mistakes to Avoid When Planning for Retirement

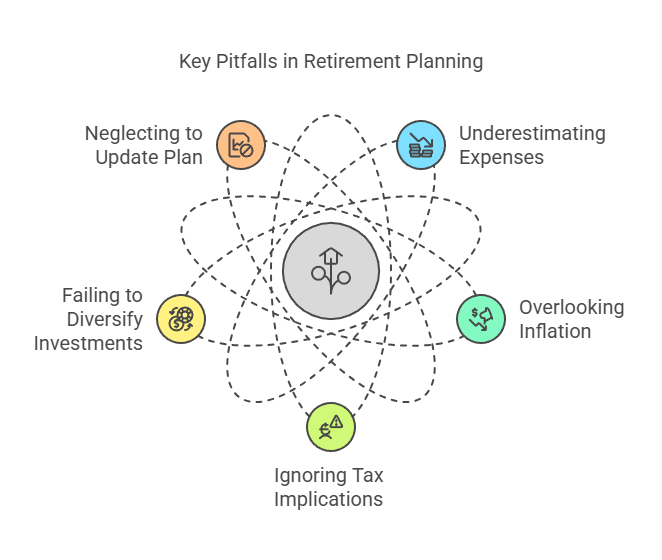

Planning for retirement is a major financial milestone, and avoiding common mistakes is crucial for a secure future. In this blog (The Top 5 Financial Mistakes to Avoid When Planning for Retirement) we’ll explore the top five financial blunders people make when preparing for retirement and provide practical advice on how to steer clear of these pitfalls. Let’s make sure you’re on the right track for a comfortable and worry-free retirement.

Mistake 1: Underestimating Retirement Expenses

- Reality: Many people underestimate how much they’ll need in retirement, leading to shortfalls. Accurately project your expenses, considering healthcare, living costs, and leisure activities, to ensure you’re financially prepared.

Mistake 2: Overlooking Inflation

- Reality: Inflation can erode your purchasing power over time. Incorporate inflation into your retirement planning by investing in assets that have the potential to grow and keep pace with rising costs.

Mistake 3: Ignoring Tax Implications

- Reality: Taxes can impact your retirement income. Plan for taxes by considering the tax treatment of your retirement accounts and incorporating tax-efficient strategies, such as using life insurance for tax-free income.

Mistake 4: Failing to Diversify Investments

- Reality: A well-diversified portfolio helps manage risk and improve returns. Avoid putting all your money into one type of investment. Consider including a mix of stocks, bonds, annuities, and life insurance products to balance growth and security.

Mistake 5: Neglecting to Update Your Plan

- Reality: Life circumstances and financial markets change, so should your retirement plan. Regularly review and update your plan to reflect changes in income, expenses, and financial goals.

Proactive Strategies for a Secure Retirement:

Implement strategies such as regularly contributing to retirement accounts, diversifying investments, and including life insurance to provide additional financial security.

Avoiding these common retirement planning mistakes can help you achieve a more secure and enjoyable retirement. By accurately estimating expenses, planning for inflation, and diversifying your investments, you can set yourself up for success. Need help refining your retirement plan? Reach out to The Policy Shop | Life Insurance for expert advice and comprehensive solutions.

The Top 5 Financial Mistakes to Avoid When Planning for Retirement

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.