03 Feb Benefits of WealthX IUL Insurance

Benefits of Indexed Universal Life Insurance (IUL)

Indexed Universal Life Insurance (IUL) is not just a policy; it’s a strategic wealth accumulation tool designed to provide both market-based growth along with market protections synonymous with insurance. If you’re considering your life insurance options, understanding the mechanics and benefits of WealthX IUL from The Policy Shop is crucial for informed decision-making. Here’s a comprehensive guide to help you grasp the essence of WealthX IUL and its potential impact on your financial well-being (Benefits of WealthX IUL Insurance):

WealthX IUL: A Closer Look

WealthX IUL, designed by The Policy Shop, blends the stability of permanent life insurance with the growth potential of indexed returns. Unlike traditional life insurance policies, WealthX IUL offers policyholders the flexibility to adjust premium payments while accumulating the highest available cash value over time. Here’s how it works:

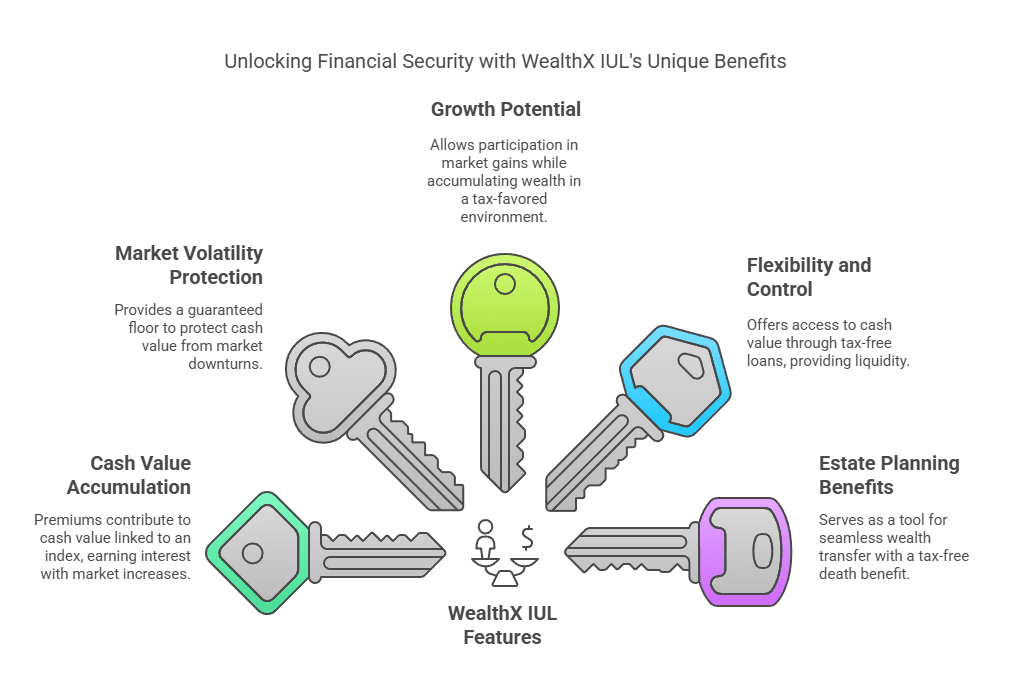

Cash Value Accumulation:

Your premium payments go towards building the cash value component of your WealthX IUL policy. This cash value is not directly invested in the stock market but is linked to the performance of an underlying index, such as the S&P 500. This means when the index goes up, your cash value is credited the corresponding amount of interest.

Protection Against Market Volatility:

One of the key advantages of WealthX IUL is its built-in protection against market downturns. Even if the index experiences losses, your cash value remains shielded by a guaranteed floor, typically set at 0%. This ensures that you never incur negative returns or loss of principal or accumulated interest due to market volatility.

Maximizing Growth Potential:

While WealthX IUL offers downside protection, it also allows you to participate in market gains. This means that when the index performs well, your cash value can experience significant growth, providing you with the opportunity to accumulate wealth over time in a tax-favored environment.

Flexibility and Control:

With WealthX IUL, you can access your cash value through tax-free policy loans. So, you have real-time liquidty of your funds within the WealthX policy.

Estate Planning Benefits:

Beyond its wealth accumulation features, WealthX IUL serves as a powerful estate planning tool. Upon your passing, your beneficiaries receive a tax-free death benefit, ensuring a seamless transfer of wealth to the next generation.

Is WealthX IUL Right for You?

WealthX IUL is well-suited for individuals seeking to balance growth potential with downside protection in their life insurance strategy. Whether you’re planning for retirement or safeguarding your family’s financial future, WealthX IUL offers a unique blend of security and opportunity.

As you explore your life insurance options, consider the potential of WealthX IUL from The Policy Shop. Consult with a trusted advisor to determine if WealthX IUL aligns with your long-term financial goals and strategies.

—————————————————————————————————————————————————————————————

Related Content | Learn More about IULs:

What is Indexed Universal Life Insurance?

Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that lasts your whole life and has two main parts: a death benefit that pays out when you pass away, and a cash value component that can grow over time. What sets IUL apart from other types of life insurance is how the cash value grows. Instead of just earning a set interest rate, the cash value in an IUL policy can also increase based on the performance of an underlying stock market index, like the S&P 500.

How The IUL Works:

When the index goes up, your cash value goes up too, but only up to a certain limit, called a “cap.” For example, if your policy has a cap of 7% and the index goes up by 8%, your cash value would only increase by 7%. However, if the index goes down, your cash value won’t lose any value – it stays the same, protecting your money from market losses.

The cash value in your IUL policy grows tax-deferred, meaning you don’t pay taxes on it until you withdraw the money. This allows your cash value to grow faster over time. Plus, because IUL is permanent life insurance, your loved ones are protected financially with a tax-free death benefit when you pass away, as long as you keep paying the premiums.

What are IUL insurance riders?

IUL policies also offer various optional add-ons called riders that can enhance your coverage. here is a list of the best:

- Adjustable Term Insurance Rider: Adds a term life insurance component to your policy for extra coverage.

- Additional Insured Rider: Extends coverage to your spouse or children.

- Long-Term Care Rider: Provides income to cover long-term care expenses like nursing home or home care.

- Chronic Illness Rider: Pays out a portion of the death benefit if you’re diagnosed with a chronic illness.

- Accelerated Benefit Rider: Provides a portion of the death benefit early if you’re diagnosed with a terminal illness.

Our team of IUL experts can help you decide if an indexed universal life insurance policy is right for your financial needs.

_____________________________________________________________________________________________________________________________________________

*Is buying indexed universal life insurance (IUL) the right move for you?

While you may be drawn to the financial benefits IUL offers, taking the next step can feel daunting without a deeper understanding. If you’re still curious after reading this article, consider consulting The Policy Shop, the top-rated IUL professionals. They can help show you all the benefits the WealthX IUL policy can add to your financial strategy.

The WealthX IUL Policy is an excellent option for those seeking life insurance protection with the potential for higher cash value growth compared to whole life or traditional universal policies.

Additionally, buying the WealthX universal life insurance allows you to make tax-advantaged contributions beyond your maximum retirement account limits. In retirement, accessing your WealthX IUL’s cash value tax-free can supplement your income, affording you the freedom to travel or pursue other activities.

For more information on indexed universal life insurance, consult with us, we will provide the details you need to confidently move forward. Make informed decisions about your financial future with The Policy Shop. #IndexedUniversalLife #LifeInsurance #RetirementPlanning #TaxAdvantages #ThePolicyShop

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.