03 Feb Exploring the World of Term Life Insurance: Understanding Its Features, Benefits, and Scenarios

Exploring Term Life Insurance

In the realm of life insurance, term life insurance stands out as a popular and practical option for individuals seeking affordable protection for specific durations. In this article, we will explore the features, benefits, and scenarios where term life insurance shines, providing valuable insights for those considering this type of coverage.

Understanding the Features of Term Life Insurance:

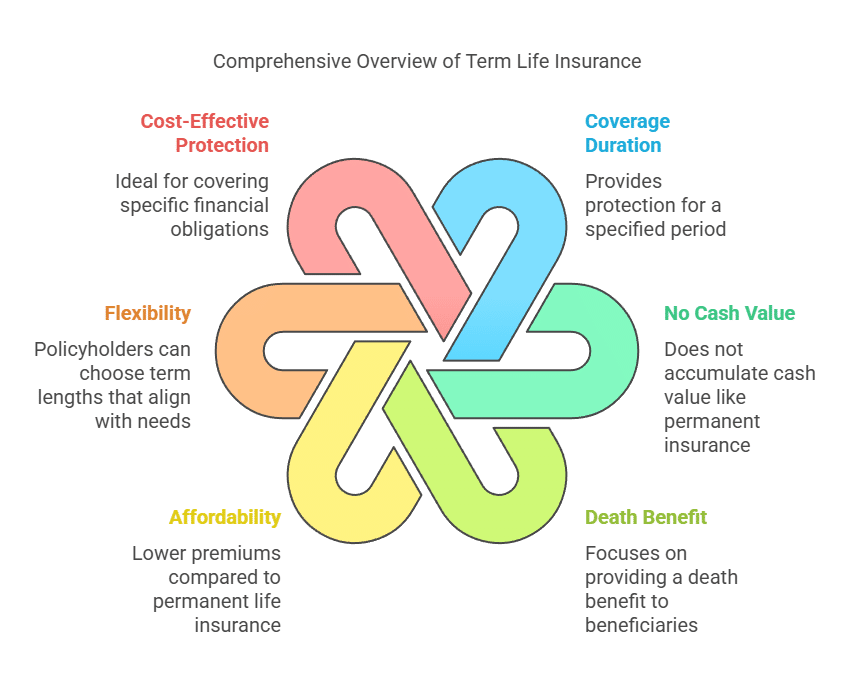

Term life insurance is a straightforward form of coverage that provides protection for a specified period, known as the term. Unlike permanent life insurance policies such as whole life or universal life, term life insurance does not accumulate cash value over time. Instead, it focuses solely on providing a death benefit to beneficiaries if the insured passes away during the term of the policy.

The Benefits of Term Life Insurance:

One of the primary benefits of term life insurance is its affordability. Because term policies offer coverage for a set duration and do not include cash value components, they tend to have lower premiums compared to permanent life insurance options. This makes term life insurance an attractive choice for individuals looking for cost-effective protection to cover specific financial obligations or responsibilities, such as mortgage payments, income replacement, or education expenses.

Additionally, term life insurance provides flexibility in terms of coverage duration. Policyholders can choose term lengths that align with their financial needs and goals, whether it’s 10, 20, or 30 years. This flexibility allows individuals to tailor their coverage to match specific milestones or obligations, providing peace of mind during critical periods of financial vulnerability.

Scenarios Where Term Life Insurance Shines:

Term life insurance is well-suited for various life stages and situations. For young families, term policies can provide essential financial protection during the years when dependents are most reliant on their income. Term insurance can also be beneficial for individuals with outstanding debts, such as mortgages or loans, as it ensures that loved ones are not burdened with financial obligations in the event of their passing.

Furthermore, term life insurance can serve as a temporary supplement to employer-sponsored coverage or provide additional protection during key life events, such as starting a business or expanding a family. By offering customizable coverage durations and affordable premiums, term life insurance offers individuals the flexibility and security they need to navigate life’s uncertainties.

Conclusion:

In conclusion, term life insurance is a valuable tool for individuals seeking affordable protection for specific durations. Its simplicity, affordability, and flexibility make it an attractive option for covering temporary financial needs and obligations. Whether safeguarding loved ones during critical life stages or providing additional peace of mind for specific scenarios, term life insurance offers reliable protection when it’s needed most.

For those considering term life insurance, The LifeENSURE Term insurance by The Policy Shop is the perfect option. With competitive rates, customizable coverage durations, and exceptional customer service, The Policy Shop ensures that individuals can secure the coverage they need to protect their loved ones and achieve financial peace of mind. Contact The Policy Shop today to explore your term life insurance options and take the first step towards a more secure future.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.