03 Feb Financial Freedom | The WealthX IUL

Financial Freedom with IULs

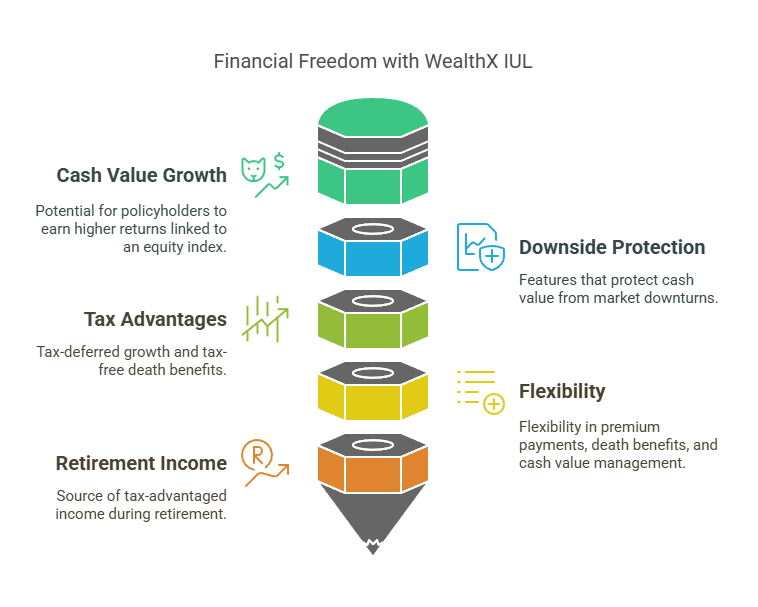

Welcome to a new era of financial planning with The Policy Shop‘s WealthX Indexed Universal Life (IUL) Policy. In today’s fast-paced world, securing your financial future requires innovative solutions that offer growth potential, downside protection, and tax advantages. WealthX IUL is designed to empower individuals and families to achieve their long-term financial goals while providing flexibility and peace of mind along the way. Let’s dive into the key features and benefits of WealthX and discover how it can transform your approach to wealth accumulation and legacy planning.

Some benefits and results associated with IULs, as highlighted in various studies and analyses, include:

Potential for Cash Value Growth:

Indexed Universal Life (IUL) policies offer the potential for cash value accumulation based on the performance of an equity index, such as the S&P 500. This means that policyholders have the opportunity to earn higher returns compared to traditional universal life insurance policies, which typically offer fixed or lower interest rates. By linking cash value growth to the performance of the index, policyholders can benefit from market gains while still having downside protection.

Example 1: John purchases an IUL policy with a cash value component linked to the S&P 500 index. Over the years, as the index experiences growth, the cash value of John’s policy also increases, providing him with enhanced wealth accumulation potential.

Example 2: Sarah chooses an IUL policy to supplement her retirement savings. With the cash value growth tied to market performance, Sarah can potentially achieve higher returns than she would with a traditional savings account or fixed-rate investment.

Example 3: Mark uses an IUL policy as part of his long-term financial strategy to build wealth and leave a legacy for his family. By leveraging the growth potential of the equity index, Mark’s policy accumulates cash value over time, providing financial security for his loved ones.

Downside Protection:

Indexed Universal Life (IUL) policies often come with downside protection features that safeguard the policy’s cash value against market downturns. Even if the underlying index experiences negative returns, the policy’s cash value won’t decrease, providing a level of security for policyholders and preserving their accumulated wealth.

Example 1: Lisa invests in an IUL policy during a period of market volatility. Despite fluctuations in the index, Lisa’s policy maintains its cash value, ensuring that her investment remains protected from market downturns.

Example 2: David, chooses an IUL policy for its downside protection feature. He values the peace of mind knowing that his policy’s cash value won’t be negatively impacted by market losses, providing stability for his financial future.

Example 3: Emily, nearing retirement age, decides to allocate a portion of her savings to an IUL policy. With the downside protection offered by the policy, Emily can confidently grow her retirement nest egg without worrying about market volatility affecting her savings.

Tax Advantages:

Indexed Universal Life (IUL) policies offer tax-deferred growth on cash value accumulation, allowing policyholders to grow their wealth over time without paying taxes on the gains until they withdraw the funds. Additionally, death benefits paid out to beneficiaries are generally income tax-free, providing additional tax advantages.

Example 1: Mike utilizes an IUL policy as part of his estate planning strategy. By leveraging the tax-deferred growth of the policy’s cash value, Mike can maximize the growth potential of his investment while minimizing tax liabilities.

Example 2: Karen purchases an IUL policy to supplement her retirement income. With tax-free death benefits, Karen’s beneficiaries can receive the proceeds of the policy without incurring income taxes, ensuring a smooth transfer of wealth to her loved ones.

Example 3: Tom, a high-income earner, chooses an IUL policy for its tax advantages. By accumulating cash value within the policy on a tax-deferred basis, Tom can effectively grow his wealth while managing his tax exposure, enhancing his overall financial plan.

Flexibility:

Indexed Universal Life (IUL) policies typically offer flexibility in premium payments, death benefits, and cash value management. Policyholders can adjust their premiums and coverage levels to suit their changing financial needs and goals, providing a customizable solution for long-term financial planning.

Example 1: Sarah experiences a change in her financial situation and needs to adjust her premium payments for her IUL policy. With the flexibility offered by the policy, Sarah can easily modify her premium amounts to align with her current budget.

Example 2: James decides to increase the death benefit of his IUL policy to provide additional financial protection for his family. With the flexibility to adjust coverage levels, James can ensure that his loved ones are adequately provided for in the event of his passing.

Example 3: Emily, a small business owner, utilizes the cash value of her IUL policy to fund a business expansion project. With the flexibility to access her policy’s cash value through loans or withdrawals, Emily can seize opportunities for growth and investment in her business.

Retirement Income:

Indexed Universal Life (IUL) policies can also serve as a retirement planning tool, providing a source of tax-advantaged income during retirement. Policyholders can access their cash value through loans or withdrawals, supplementing other retirement income sources like pensions and Social Security.

Example 1: John plans to retire early and supplement his retirement income with funds from his IUL policy. By leveraging the cash value of the policy, John can enjoy a steady stream of tax-advantaged income to support his desired lifestyle in retirement.

Example 2: Lisa uses her IUL policy as a tax-efficient source of retirement income. By accessing the policy’s cash value through withdrawals, Lisa can supplement her other retirement savings while minimizing her tax liabilities.

Example 3: David incorporates an IUL policy into his retirement strategy to provide a reliable income stream during his golden years. With the ability to access his policy’s cash value without penalty, David can enjoy financial security and peace of mind throughout his retirement.

Conclusion:

In conclusion, WealthX from The Policy Shop is more than just a life insurance policy—it’s a strategic financial tool that empowers you to build and protect your wealth for generations to come. With its potential for cash value growth, downside protection, tax advantages, flexibility, and retirement income options, WealthX offers a comprehensive solution for your financial needs. Take the first step towards financial freedom today by exploring WealthX and partnering with The Policy Shop to secure your future legacy.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.