03 Feb Benefits of Indexed Universal Life Insurance (IUL)

Benefits of Indexed Universal Life Insurance (IUL)

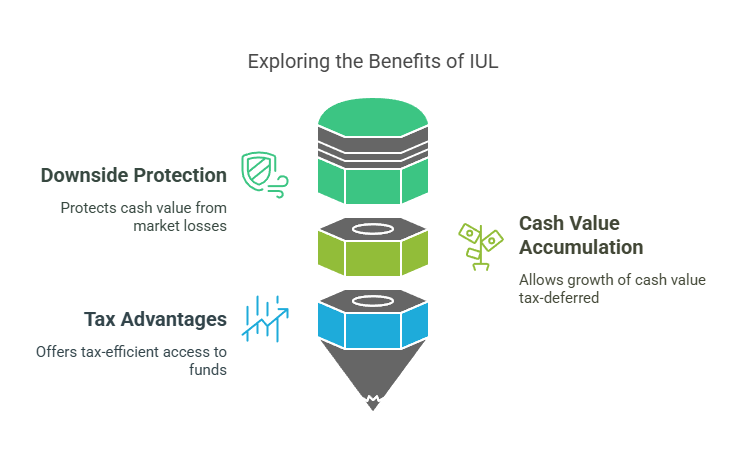

Indexed Universal Life Insurance (IUL) is a versatile financial tool that offers a combination of protection and growth potential. In this blog post, we’ll delve into the unique advantages of IUL, including downside protection, cash value accumulation, and tax advantages. Additionally, we’ll provide real-life examples of how IUL policies have helped policyholders achieve their financial goals.

-

Downside Protection

One of the key benefits of IUL is its downside protection feature. Unlike traditional investments that are subject to market volatility, IUL policies offer a level of protection against market downturns. This is achieved through the use of indexed accounts, which track the performance of a stock market index, such as the S&P 500. If the index experiences a loss, the policyholder’s cash value is protected from those losses, ensuring that their principal remains intact.

Real-Life Example: John, a 45-year-old business owner, purchased an IUL policy to supplement his retirement savings. During a market downturn, the S&P 500 index experienced a significant decline. However, thanks to the downside protection feature of his IUL policy, John’s cash value remained unaffected, providing him with peace of mind during turbulent market conditions.

-

Cash Value Accumulation

Another benefit of IUL is its cash value accumulation component. As premiums are paid into the policy, a portion is allocated to a cash value account, which grows over time. The cash value accumulates on a tax-deferred basis, meaning policyholders won’t pay taxes on the growth until they access it. This cash value can be accessed through policy loans or withdrawals for various financial needs, such as supplementing retirement income or covering unexpected expenses.

Real-Life Example: Sarah, a 35-year-old mother of two, purchased an IUL policy to provide financial protection for her family. Over the years, the cash value of her policy has grown significantly, allowing her to take out policy loans to help pay for her children’s college tuition. By leveraging the cash value of her IUL policy, Sarah has been able to achieve her family’s financial goals while maintaining peace of mind.

-

Tax Advantages

IUL policies offer several tax advantages that can benefit policyholders. As mentioned earlier, the cash value accumulation component grows on a tax-deferred basis, allowing policyholders to maximize their investment returns. Additionally, policy loans and withdrawals are generally tax-free up to the amount of premiums paid into the policy, providing a tax-efficient way to access funds when needed.

Real-Life Example: Mark and Lisa, a married couple in their 50s, purchased an IUL policy as part of their retirement planning strategy. During retirement, they began taking tax-free withdrawals from the cash value of their policy to supplement their income. By leveraging the tax advantages of their IUL policy, Mark and Lisa were able to enjoy a comfortable retirement lifestyle without worrying about the tax implications of accessing their funds.

Conclusion

Indexed Universal Life Insurance (IUL) offers a unique set of benefits for individuals seeking both protection and growth potential. From downside protection and cash value accumulation to tax advantages, IUL policies provide policyholders with a versatile financial solution to help them achieve their long-term financial goals. By understanding the benefits of IUL and how they can be applied in real-life scenarios, individuals can make informed decisions to secure their financial future with confidence.

Contact The Policy Shop today & let us help you build a brighter future!

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.