04 Feb Unlocking Growth: Cash Value Accumulation | WealthX IUL

Cash Value Accumulation in IULs

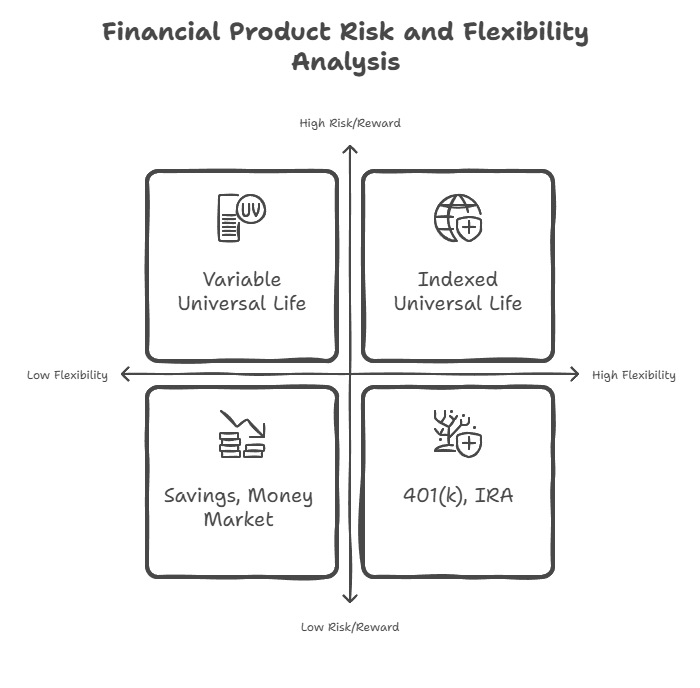

Indexed Universal Life (IUL) policies offered by The Policy Shop, such as WealthX IUL, present a unique avenue for cash value accumulation, leveraging the performance of stock market indices. Let’s delve into how the cash value grows within WealthX IUL and what sets it apart.

Linking Cash Value Growth to Market Indices

WealthX IUL policies accumulate cash value by tracking the returns of a chosen stock market index. Policyholders have the flexibility to select the index they want their cash value account to follow, tailoring their investment strategy to their preferences and risk tolerance.

Capped Returns and Guaranteed Floors

Returns on the cash value of WealthX IUL policies are typically capped at 8-9%, offering policyholders the opportunity to benefit from market upswings while limiting exposure to excessive gains. Additionally, these policies often come with a floor of 0%, ensuring that even in the event of negative index performance, the cash value will not decrease.

Benefits of WealthX IUL Cash Value Growth

- Market Participation with Risk Management: By linking cash value growth to market indices, WealthX IUL policies allow policyholders to participate in market gains while providing downside protection through capped returns and guaranteed floors.

- Flexibility and Customization: Policyholders have the flexibility to choose the index that aligns with their investment goals and risk appetite, empowering them to tailor their wealth accumulation strategy.

- Steady Growth Potential: With capped returns and guaranteed floors, WealthX IUL offers a balanced approach to cash value accumulation, providing the potential for steady, sustainable growth over time.

|

|

Conclusion: Harnessing Growth Potential with WealthX IUL

WealthX Indexed Universal Life policies from The Policy Shop offer a powerful means of cash value accumulation, leveraging the performance of market indices while mitigating risk through capped returns and guaranteed floors. By choosing WealthX IUL, policyholders can unlock the potential for steady, sustainable growth, providing financial security and peace of mind for the future. Explore the benefits of WealthX IUL today at www.thepolicyshop.com and embark on a journey towards financial prosperity.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.