03 Feb Choosing the Right Life Insurance Policy

The Right Life Insurance Policy

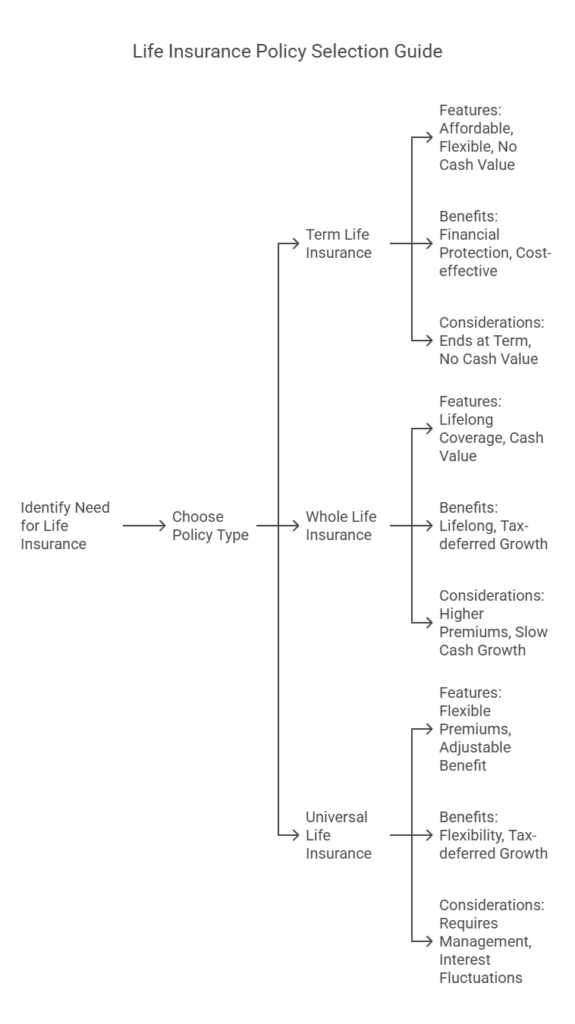

Life insurance is a critical component of financial planning, providing protection and peace of mind for you and your loved ones. However, with so many options available, selecting the right policy can feel overwhelming. In this comprehensive guide, we’ll walk you through the various types of life insurance policies, including term, whole life, and universal life, helping you make an informed decision that aligns with your financial goals and needs.

Term life insurance is the most straightforward and affordable type of life insurance. It provides coverage for a specified period, typically 10, 20, or 30 years, and pays out a death benefit if the insured passes away during the term. Term policies do not accumulate cash value and are designed to provide financial protection during the policy’s term.

Features:

- Affordable premiums compared to other types of life insurance.

- Flexible coverage options, allowing you to choose the coverage amount and term length that best suits your needs.

- Pure death benefit protection with no cash value accumulation.

Benefits:

- Provides financial protection for a specific period, such as until your children are grown or your mortgage is paid off.

- Offers peace of mind knowing that your loved ones will be financially protected if something happens to you during the term of the policy.

- Can be a cost-effective way to obtain a large death benefit for a temporary need, such as covering a mortgage or educational expenses.

Considerations:

- Coverage ends at the expiration of the term, and premiums may increase if you renew the policy.

- Does not build cash value or offer investment opportunities like other types of life insurance.

- May not be suitable for long-term financial planning or estate preservation needs.

Whole life insurance provides coverage for your entire life, as long as premiums are paid, and also includes a cash value component that grows over time. Premiums are typically higher than term life insurance but remain level for the life of the policy. Whole life policies offer both death benefit protection and a savings component.

Features:

- Guaranteed death benefit coverage for life, as long as premiums are paid.

- Cash value accumulation that grows tax-deferred over time and can be accessed through policy loans or withdrawals.

- Level premiums that do not increase as you age.

Benefits:

- Provides lifelong coverage and guarantees a death benefit for your beneficiaries.

- Builds cash value over time, which can be used for supplemental retirement income, emergency expenses, or other financial needs.

- Offers tax-deferred growth on cash value, meaning you won’t pay taxes on the growth until you access it.

Considerations:

- Higher premiums compared to term life insurance, making it less affordable for some individuals.

- Cash value accumulation may take several years to become significant.

- Policy loans or withdrawals can reduce the death benefit and cash value if not repaid.

Universal life insurance is a flexible permanent life insurance policy that allows you to adjust your premium payments and death benefit over time. Like whole life insurance, universal life policies include a cash value component, but they offer more flexibility in premium payments and coverage options.

Features:

- Flexible premium payments that allow you to adjust the amount and frequency of payments based on your financial situation.

- Adjustable death benefit options, allowing you to increase or decrease coverage as needed.

- Cash value accumulation that earns interest based on current market rates.

Benefits:

- Offers flexibility in premium payments and coverage options, making it easier to adapt to changes in your financial circumstances.

- Provides permanent coverage with a death benefit that can be tailored to your needs.

- Allows for tax-deferred growth on cash value and potential access to funds through policy loans or withdrawals.

Considerations:

- Requires active management to ensure the policy remains adequately funded and the death benefit stays in force.

- Cash value accumulation is subject to interest rate fluctuations and may not perform as expected during periods of low interest rates.

- Policy loans or withdrawals can reduce the death benefit and cash value if not repaid.

Conclusion

Choosing the right life insurance policy is a significant decision that requires careful consideration of your financial goals, needs, and budget. Whether you opt for term, whole life, or universal life insurance, each type of policy offers unique features and benefits to meet your individual circumstances. By understanding the features, benefits, and considerations of each type of policy, you can make an informed decision that provides financial security and peace of mind for you and your loved ones.

Contact The Policy Shop today & let us help you build a brighter future!

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.