03 Feb CollegePLUS IUL vs. 529 Plan: Informed Decisions

CollegePLUS IUL vs. 529 Plan

When it comes to planning for higher education expenses, selecting the right savings vehicle is crucial for achieving your financial goals. In this article, we’ll compare two popular options: CollegePLUS Indexed Universal Life (IUL) and 529 college savings plans. By examining their features, benefits, and considerations, you’ll be equipped to make an informed decision that aligns with your family’s needs and aspirations.

Key Points:

CollegePLUS Indexed Universal Life (IUL): Discover the unique features of CollegePLUS IUL, which not only provides life insurance protection but also offers cash value accumulation and tax advantages. Unlike traditional 529 plans, CollegePLUS IUL serves as a flexible funding vehicle that can be utilized for various purposes beyond education expenses.

529 College Savings Plans: Explore the benefits of 529 plans, such as tax-deferred growth and potential state tax deductions. However, be mindful of the limitations and restrictions associated with these plans, including penalties for non-education-related withdrawals and limited investment options.

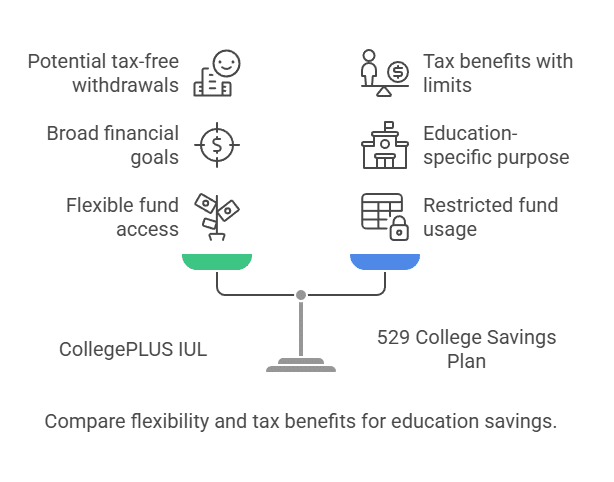

Flexibility and Control: Understand how CollegePLUS IUL offers greater flexibility and control over education savings compared to 529 plans. With CollegePLUS IUL, policyholders have the freedom to access funds for retirement, emergencies, or other financial goals, providing versatility for evolving financial needs.

Tax Advantages: Compare the tax advantages of CollegePLUS IUL and 529 plans, including tax-deferred growth and potential tax-free withdrawals for qualified education expenses. Consider how these tax benefits may impact your overall financial strategy and estate planning goals.

Long-Term Planning Considerations: Evaluate the long-term implications of choosing CollegePLUS IUL or a 529 plan for education savings. Consider factors such as performance, policy fees, and estate planning objectives to ensure your chosen strategy aligns with your financial objectives.

Conclusion:

Selecting the right education savings strategy is paramount for achieving your higher education goals while maximizing tax advantages and financial flexibility. By comparing CollegePLUS IUL and 529 plans and understanding their respective features and benefits, you can make a well-informed decision that sets the foundation for your loved ones’ future success. Contact The Policy Shop today to explore your education savings options and create a customized plan tailored to your family’s needs.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.