04 Feb Fixed vs. Variable Annuities: Understanding the Key Differences

Fixed vs. Variable Annuities

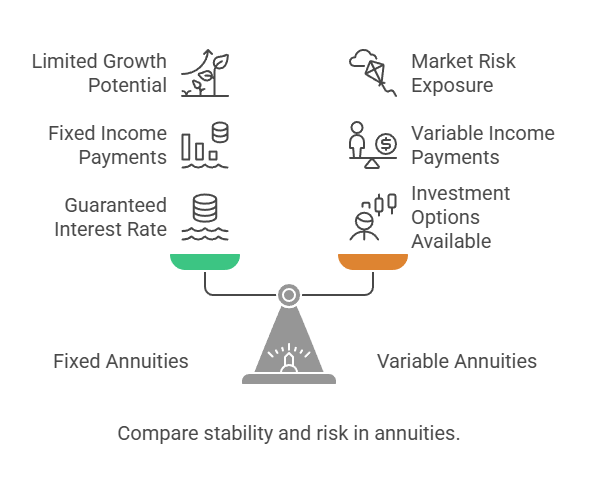

Fixed and variable annuities are two common types of annuity contracts, each with its own unique features and benefits. Understanding the key differences between these two types of annuities can help you make informed decisions when considering annuity options for your financial future. In this article, we’ll explore the fundamental differences between fixed and variable annuities to help you determine which may be the best fit for your needs.

Fixed Annuities:

- Guaranteed Interest Rate: Fixed annuities offer a guaranteed interest rate on the principal amount invested, providing a predictable and stable return on investment.

- Fixed Income Payments: Policyholders receive fixed income payments for a specified period or for life, providing a steady stream of income that is not subject to market fluctuations.

- Limited Growth Potential: While fixed annuities offer stability and predictability, they typically have lower growth potential compared to variable annuities due to the fixed interest rate.

Variable Annuities:

- Investment Options: Variable annuities offer a range of investment options, including mutual funds or separate accounts, allowing policyholders to potentially achieve higher returns through market participation.

- Market Risk: Unlike fixed annuities, the value of variable annuities fluctuates with the performance of the underlying investments, exposing policyholders to market risk.

- Variable Income Payments: Income payments from variable annuities can vary based on the performance of the underlying investments, providing the potential for higher income but also greater volatility.

Fees and Expenses:

- Fixed annuities typically have lower fees and expenses compared to variable annuities, making them a more cost-effective option for some investors.

- Variable annuities may have higher fees and expenses, including investment management fees, mortality and expense charges, and administrative fees, which can impact overall returns.

Choosing between fixed and variable annuities requires careful consideration of your individual financial goals, risk tolerance, and investment preferences. Fixed annuities offer stability and predictability, while variable annuities provide the potential for higher returns but also come with greater market risk. At The Policy Shop, we’re here to help you understand the differences between fixed and variable annuities and choose the option that best aligns with your needs and objectives.

Contact The Policy Shop today to schedule your personalized consultation and take the first step towards securing your financial future.