03 Feb How Does an Indexed Universal Life (IUL) Policy Work?

How an IUL Works

Indexed Universal Life (IUL) policies have gained popularity as a flexible and tax-efficient tool for retirement planning and wealth accumulation. Let’s delve into how IUL policies work and the benefits they offer to policyholders.

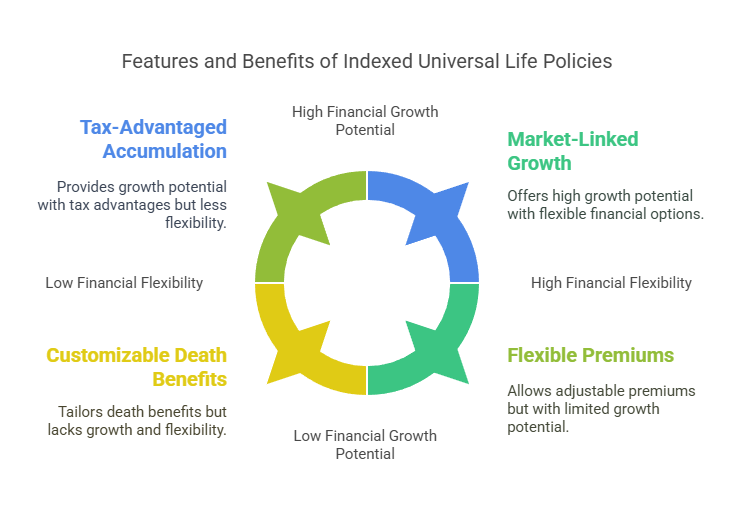

Market-Linked Growth:

IUL policies offer the potential for cash value growth linked to the performance of a selected stock market index, such as the S&P 500. Policyholders can benefit from market gains while being protected from market downturns, making IUL policies an attractive option for those seeking growth potential with downside protection.

Flexible Premiums and Benefits:

IUL policies provide flexibility in premium payments, allowing policyholders to adjust their contributions over time to suit their financial circumstances. Additionally, policyholders can customize their death benefits and access cash value through loans or withdrawals, providing versatility in financial planning.

Tax-Advantaged Accumulation:

One of the key advantages of IUL policies is tax-deferred growth on cash value accumulation. Policyholders can grow their cash value without incurring current income taxes on the gains, potentially maximizing the growth potential of their investments. Additionally, death benefits paid out to beneficiaries are generally income tax-free, providing tax advantages for estate planning.

Example: For example, Mark purchases an Indexed Universal Life (IUL) policy to supplement his retirement savings and provide financial protection for his family. The policy allows Mark to allocate a portion of his premiums to indexed accounts, providing potential for market-linked growth, while also offering flexibility in premium payments and access to cash value.

Conclusion:

Indexed Universal Life (IUL) policies offer a unique combination of market-linked growth, flexibility, and tax advantages that can help individuals achieve their financial goals. By understanding how IUL policies work and their benefits, individuals can make informed decisions to secure their financial future.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.