07 Sep How Does Indexed Universal Life Insurance Work?

How Does Indexed Universal Life Insurance Work?

Indexed Universal Life Insurance (IUL) is a unique financial product that offers policyholders the opportunity to build cash value over time while providing a death benefit to beneficiaries. What sets IUL apart from other forms of life insurance is how the policy cash value is credited.

Index Performance and Crediting Methods

The term “index” in Indexed Universal Life Insurance refers to the underlying indices used to determine how the policy’s cash value is credited. While the most common index used is the S&P 500, carriers may offer access to various other indices as well.

Importantly, the policy is not directly invested in the chosen index. Instead, insurance companies purchase options on the index, allowing them to eliminate negative returns in years where the index performs poorly. This ensures that the policy’s crediting rate is contractually guaranteed to be at least zero, regardless of index performance.

Crediting Methods

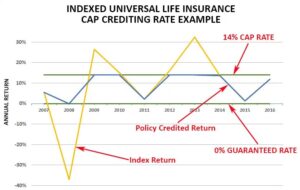

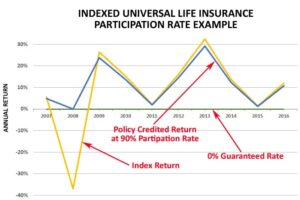

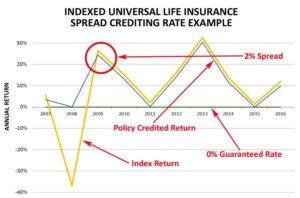

There are three primary crediting methods used for IUL policies: cap rate, participation rate, and spread. These methods determine how much of the index’s positive returns will be credited to the policy’s cash value.

- Cap Rates: Cap rates place a limit on how much the cash value can be credited based on index performance. For example, if the cap rate is 14%, the policy cannot be credited more than this, even if the index return exceeds 14%.

- Participation Rates: Participation rates represent the percentage of the index return that the policy will be credited. For instance, a 90% participation rate means the policy will be credited 90% of the index return.

- Spreads: Spreads are expressed as a percentage and act like management fees. The cash value is credited the gross index return less the spread.

Conclusion: Unlocking the Potential with WealthX IUL

In conclusion, Indexed Universal Life Insurance offers policyholders a unique opportunity to build cash value while providing financial protection for their loved ones. By leveraging innovative crediting methods like cap rates, participation rates, and spreads, policyholders can potentially achieve attractive returns while safeguarding against market downturns.

If you’re looking for a reliable IUL solution that combines growth potential with downside protection, consider exploring WealthX IUL from The Policy Shop. With expert guidance and a commitment to customer satisfaction, The Policy Shop can help you navigate the complexities of IUL and tailor a policy to fit your unique financial goals. Visit www.thepolicyshop.com to learn more and take the first step towards securing your financial future.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.