11 Sep How IULs Work | Expense Structure

How IULs Work

Indexed Universal Life Insurance (IUL) offers a distinctive expense structure that differs from traditional investment vehicles. While most investors are accustomed to consistent annual fees, such as management or advisory fees, IUL operates differently, with expenses varying significantly over the life of the policy.

Early Year Expenses vs. Later Year Expenses

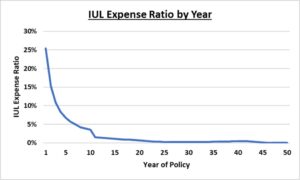

In the early years of an IUL policy, expenses are typically high, contrasting sharply with the lower expenses seen in later years. This expense pattern, illustrated in the chart below, reflects the front-loaded nature of IUL policies.

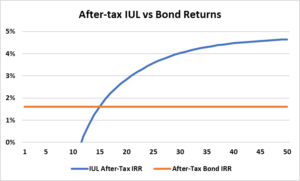

These high early year expenses might seem daunting initially, leading to lower returns compared to strategies like bonds. However, as the policy matures, expenses decrease substantially, often amounting to less than 1% of the policy value. This decline in expenses, coupled with tax-free growth, positions the IUL policy for significant long-term growth, outperforming traditional bond strategies.

Maximizing IUL Value

To fully capitalize on the potential of an IUL policy, it’s essential to choose a low-expense product and commit to long-term ownership. By selecting a policy with minimal expenses and maintaining it over an extended period, policyholders can maximize their Internal Rate of Return (IRR) as the benefits of reduced expenses compound over time.

Conclusion: Seizing the Potential with WealthX IUL

Indexed Universal Life Insurance offers a dynamic approach to wealth accumulation, with an expense structure that prioritizes long-term growth and financial security. Despite high early year expenses, the combination of low later year expenses and tax-free growth positions IUL as a powerful tool for building wealth over time.

For those seeking to optimize the value of their IUL policy, selecting a low-expense product and committing to long-term ownership is paramount. With WealthX IUL from The Policy Shop, policyholders can access a product designed to maximize growth potential while minimizing expenses, ensuring a secure financial future for themselves and their loved ones. Explore WealthX IUL today at www.thepolicyshop.com and take the first step towards unlocking your financial potential.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.