04 Feb Indexed Universal Life (IUL) Insurance Policies

A COMPREHENSIVE OVERVIEW of indexed Universal Life Insurance (IUL) Policies

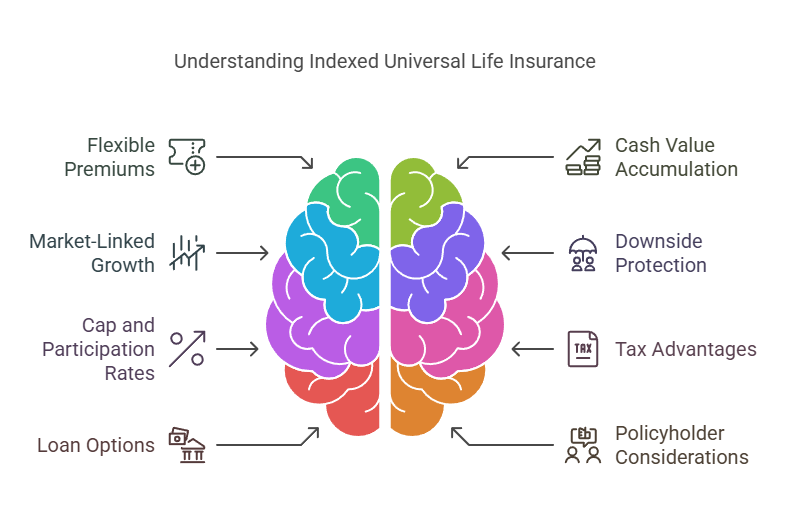

In the vast landscape of life insurance, one standout option that combines protection and potential growth is the Indexed Universal Life (IUL) insurance policy. Let’s delve into the intricacies of IUL, demystifying its features and benefits for a comprehensive understanding.

Understanding the Basics:

At its core, IUL is a form of permanent life insurance that provides a death benefit to beneficiaries, but it distinguishes itself through a unique cash accumulation component linked to market indexes.

Flexible Premiums and Cash Value Accumulation:

One of the key attractions of IUL is flexibility. Policyholders have the freedom to adjust their premium payments within certain limits. As premiums are paid, a portion goes toward the cost of insurance, while the remainder accumulates as cash value. This cash value is linked to the performance of selected market indexes, offering potential for growth.

Market-Linked Growth with Downside Protection:

Unlike traditional whole life insurance, where the cash value grows at a fixed interest rate, IUL policies tie returns to market indexes, such as the S&P 500. This dynamic feature allows policyholders to benefit from upward market movements, with a crucial safeguard – protection against market downturns. Even if the market experiences negative returns, the policy’s cash value won’t decline.

Cap Rates and Participation Rates:

Two essential elements in IUL are cap rates and participation rates. The cap rate is the maximum percentage by which the policy’s cash value can increase based on index performance during a specific period. Participation rates determine the percentage of the index’s gain that is credited to the policy. Understanding these factors helps policyholders gauge the growth potential of their cash value.

Tax Advantages:

IUL policies come with tax advantages. The cash value growth is tax-deferred, meaning policyholders don’t pay taxes on the accrued interest unless they withdraw the funds. Additionally, death benefits are generally income tax-free for beneficiaries.

Loan Options and Withdrawals:

One of the unique aspects of IUL is the ability to take loans against the cash value. Policyholders can access funds for various needs, such as education, emergencies, or supplemental retirement income. However, it’s crucial to understand the impact of loans on the policy’s performance and potential tax implications.

Considerations for Policyholders:

While IUL offers an enticing combination of flexibility and growth potential, it’s essential for policyholders to carefully review policy terms, understand index crediting methods, and regularly assess the policy’s performance. Consulting with a financial advisor can provide personalized insights based on individual financial goals.

In essence, Indexed Universal Life insurance is a versatile financial tool that aligns life protection with the potential for market-linked growth. By navigating the intricacies of IUL, individuals can harness its power to secure their loved ones’ future while pursuing financial goals.

—————————————————————————————————————————————————————————————

Related Content | Learn More about IULs:

What is Indexed Universal Life Insurance?

Here is the best explanation:

Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that lasts your whole life and has two main parts: a death benefit that pays out when you pass away, and a cash value component that can grow over time. What sets IUL apart from other types of life insurance is how the cash value grows. Instead of just earning a set interest rate, the cash value in an IUL policy can also increase based on the performance of an underlying stock market index, like the S&P 500.

How The IUL Works:

When the index goes up, your cash value goes up too, but only up to a certain limit, called a “cap.” For example, if your policy has a cap of 7% and the index goes up by 8%, your cash value would only increase by 7%. However, if the index goes down, your cash value won’t lose any value – it stays the same, protecting your money from market losses.

The cash value in your IUL policy grows tax-deferred, meaning you don’t pay taxes on it until you withdraw the money. This allows your cash value to grow faster over time. Plus, because IUL is permanent life insurance, your loved ones are protected financially with a tax-free death benefit when you pass away, as long as you keep paying the premiums.

What are IUL insurance riders?

IUL policies also offer various optional add-ons called riders that can enhance your coverage. here is a list of the best:

- Adjustable Term Insurance Rider: Adds a term life insurance component to your policy for extra coverage.

- Additional Insured Rider: Extends coverage to your spouse or children.

- Long-Term Care Rider: Provides income to cover long-term care expenses like nursing home or home care.

- Chronic Illness Rider: Pays out a portion of the death benefit if you’re diagnosed with a chronic illness.

- Accelerated Benefit Rider: Provides a portion of the death benefit early if you’re diagnosed with a terminal illness.

Our team of IUL experts can help you decide if an indexed universal life insurance policy is right for your financial needs.

Stay tuned for regular updates and subscribe to our newsletter for the latest industry trends and exclusive offers. Trust The Policy Shop to be your ultimate resource for all things Life insurance related. Start your journey to financial security today!

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.

*Is buying indexed universal life insurance (IUL) the right move for you?

While you may be drawn to the financial benefits IUL offers, taking the next step can feel daunting without a deeper understanding. If you’re still curious after reading this article, consider consulting The Policy Shop, the top-rated IUL professionals. They can help show you all the benefits the WealthX IUL policy can add to your financial strategy.

The WealthX IUL Policy is an excellent option for those seeking life insurance protection with the potential for higher cash value growth compared to whole life or traditional universal policies.

Additionally, buying the WealthX universal life insurance allows you to make tax-advantaged contributions beyond your maximum retirement account limits. In retirement, accessing your WealthX IUL’s cash value tax-free can supplement your income, affording you the freedom to travel or pursue other activities.

For more information on indexed universal life insurance, consult with us, we will provide the details you need to confidently move forward. Make informed decisions about your financial future with the Policy Shop. #IndexedUniversalLife #LifeInsurance #RetirementPlanning #TaxAdvantages #ThePolicyShop