03 Feb Maximizing Financial Security: The WealthX IUL Advantage

IULs-Maximizing Financial Security

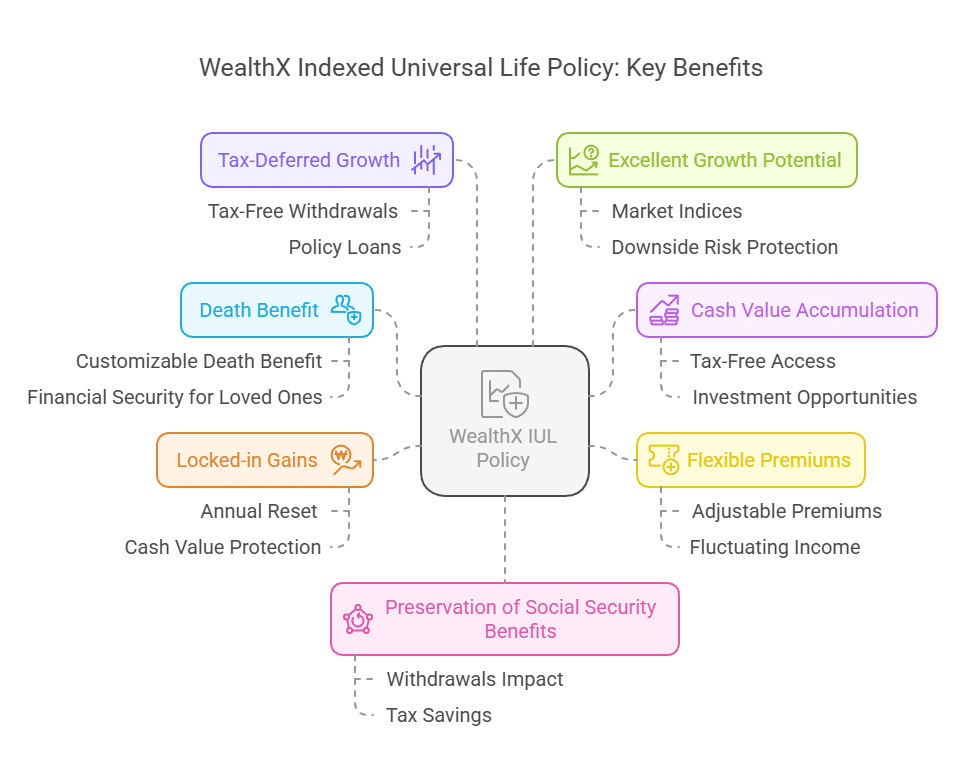

At The Policy Shop, we believe in providing our clients with comprehensive financial solutions that prioritize long-term stability and prosperity. One such solution that stands out for its numerous benefits is the WealthX Indexed Universal Life (IUL) policy. Let’s explore the top eight advantages of the WealthX IUL and why it’s a compelling choice for securing your financial future.

Death Benefit –

Ensuring Family Protection The primary function of any life insurance policy, including the WealthX IUL, is to provide a death benefit that offers financial security to your loved ones in the event of your passing. With WealthX IUL, you can customize your death benefit, whether fixed or increasing, to suit your family’s needs. This ensures that your beneficiaries are safeguarded from financial hardship, offering peace of mind during challenging times.

Cash Value Accumulation

WealthX IUL isn’t just about protection—it’s also a vehicle for wealth accumulation. Unlike term life insurance, IUL policies feature a cash value account that grows over time as you contribute premiums. This cash value can be accessed tax-free for various purposes, such as investments in real estate or stocks, providing you with financial flexibility and opportunities for growth.

Flexible Premiums for Enhanced Affordability

With WealthX IUL, you’re not locked into rigid premium payments. Instead, you have the flexibility to adjust your premiums according to your financial circumstances. This feature is particularly beneficial for individuals with fluctuating income, allowing them to tailor their policy to their changing needs and budgetary constraints.

Locked-in Gains and Annual Reset

One of the standout features of WealthX IUL is its ability to lock in gains annually, ensuring that your accumulated wealth is protected from market downturns. Moreover, the annual reset mechanism means that you start each year with a clean slate, unaffected by previous losses. This safeguards your policy’s cash value and sets the stage for sustained growth over time, regardless of market fluctuations.

No Required Distributions or Penalties

Unlike retirement accounts such as IRAs or 401(k)s, WealthX IUL does not impose mandatory distributions, allowing you to maintain control over your cash value accumulation. This flexibility extends to accessing your cash value at any age without penalties, providing you with financial freedom and security throughout your lifetime.

Tax-Deferred Growth and Tax-Free Access

WealthX IUL offers the dual advantage of tax-deferred growth and tax-free access to your cash value. While your cash value grows tax-deferred within the policy, you can access it through tax-free withdrawals or policy loans, providing you with a tax-efficient strategy for building and accessing your wealth.

Excellent Growth Potential

With WealthX IUL, you benefit from the potential upside growth of market indices without exposing yourself to significant downside risk. This balanced approach allows you to capitalize on market gains while protecting your cash value from potential losses, making WealthX IUL an attractive option for individuals seeking long-term growth and stability.

Preservation of Social Security Benefits

One often overlooked advantage of WealthX IUL is its impact on Social Security benefits. Unlike retirement accounts, withdrawals from WealthX IUL do not impact your Social Security income, potentially saving you thousands of dollars in taxes and ensuring that your retirement funds go further.

In conclusion, the WealthX Indexed Universal Life policy offered by The Policy Shop combines the benefits of life insurance protection with wealth accumulation and tax efficiency, making it a compelling choice for individuals looking to secure their financial future. To learn more about how WealthX IUL can benefit you and your family, contact us today and embark on the path to financial prosperity.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.