03 Feb Securing Your Financial Future with WealthX (IUL)

Financial Security, with IULs

Welcome to “Mastering Financial Security, with The WealthX IUL” your comprehensive roadmap to achieving lasting financial stability and peace of mind with WealthX Indexed Universal Life Insurance (IUL) from The Policy Shop. In today’s ever-changing financial landscape, navigating the complexities of financial planning can be daunting. However, with WealthX IUL, you can rest assured knowing that you have a powerful tool at your disposal to secure your financial future.

At The Policy Shop, we understand that each individual’s financial situation is unique. That’s why we’re committed to providing innovative solutions tailored to your specific needs and goals. Whether you’re planning for retirement, protecting your family’s future, or building a legacy, WealthX IUL offers unparalleled flexibility and versatility to help you achieve your long-term financial objectives.

Protecting Your Assets: One of the primary benefits of WealthX Indexed Universal Life Insurance is its ability to protect your assets and provide financial security for your loved ones. With its death benefit feature, WealthX IUL ensures that your beneficiaries will receive a tax-free payout in the event of your passing, allowing you to leave a lasting legacy for future generations. This invaluable protection provides peace of mind knowing that your loved ones will be taken care of financially, no matter what life may bring.

Growing Your Wealth: In addition to protecting your assets, WealthX IUL offers the potential for significant wealth accumulation over time. Through its cash value component, WealthX IUL allows you to build tax-deferred savings that can grow over time, providing you with a valuable source of supplemental income during retirement or other life milestones. With WealthX IUL, you have the opportunity to grow your wealth steadily and securely, without exposing yourself to unnecessary risk.

Achieving Your Long-Term Financial Goals: Whether your financial goals include retiring comfortably, funding your children’s education, or traveling the world, WealthX IUL can help you turn your dreams into reality. By providing a reliable and flexible source of income, WealthX IUL empowers you to pursue your long-term financial goals with confidence, knowing that you have a solid foundation in place to support your aspirations.

In “Mastering Financial Security,” we’ll explore in-depth the various features and benefits of WealthX IUL, empowering you with the knowledge and tools you need to make informed decisions about your financial future. From understanding how WealthX IUL works to maximizing its potential for wealth accumulation and income generation, this guide will equip you with the insights and strategies necessary to achieve lasting financial security.

Thank you for choosing The Policy Shop as your partner in financial planning. Together, we’ll embark on a journey towards financial empowerment and peace of mind. Let’s start mastering financial security with WealthX IUL today.

CHAPTER 1: UNDERSTANDING WEALTHX IUL

Welcome to Chapter 1, where we embark on a journey to unravel the fundamentals of WealthX Indexed Universal Life Insurance (IUL) and explore why it stands as a game-changer for financial security. Unlike traditional life insurance policies, WealthX IUL offers a unique blend of protection and growth potential, making it a versatile financial tool that adapts to your evolving needs and aspirations.

The Dual Benefits: At the heart of WealthX IUL lies its ability to provide both protection and growth potential. Unlike conventional life insurance policies that solely focus on providing a death benefit, WealthX IUL combines the security of a death benefit with the opportunity for cash value accumulation. This dual nature allows you to safeguard your loved ones’ financial future while simultaneously building wealth for yourself.

Tax-Deferred Growth: One of the key features that sets WealthX IUL apart is its ability to facilitate tax-deferred growth of your cash value. This means that the growth of your cash value is not subject to immediate taxation, allowing your funds to grow faster and more efficiently over time. By deferring taxes until withdrawal, you can potentially maximize your overall returns and accelerate your wealth accumulation strategy.

Flexibility in Premium Payments: Another hallmark feature of WealthX IUL is its flexibility in premium payments. Unlike traditional life insurance policies with fixed premiums, WealthX IUL allows you to adjust your contributions according to your financial situation and goals. Whether you want to increase, decrease, or even temporarily suspend your premium payments, WealthX IUL offers you the freedom to tailor your policy to meet your evolving needs.

Versatility and Value: By grasping the core features of WealthX IUL, you’ll uncover its unparalleled versatility and value as a financial instrument. From providing financial protection for your loved ones through a death benefit to accumulating cash value for future needs, WealthX IUL offers a comprehensive solution that addresses various aspects of your financial plan. Whether you’re planning for retirement, funding education expenses, or leaving a legacy, WealthX IUL can adapt to your unique circumstances and aspirations.

As we delve deeper into the world of WealthX IUL in the subsequent chapters, you’ll gain a deeper understanding of its mechanics, benefits, and strategic applications. Get ready to unlock the full potential of WealthX IUL and embark on a journey towards greater financial security and prosperity.

CHAPTER 2: UNLEASHING THE POWER OF WEALTHX IUL

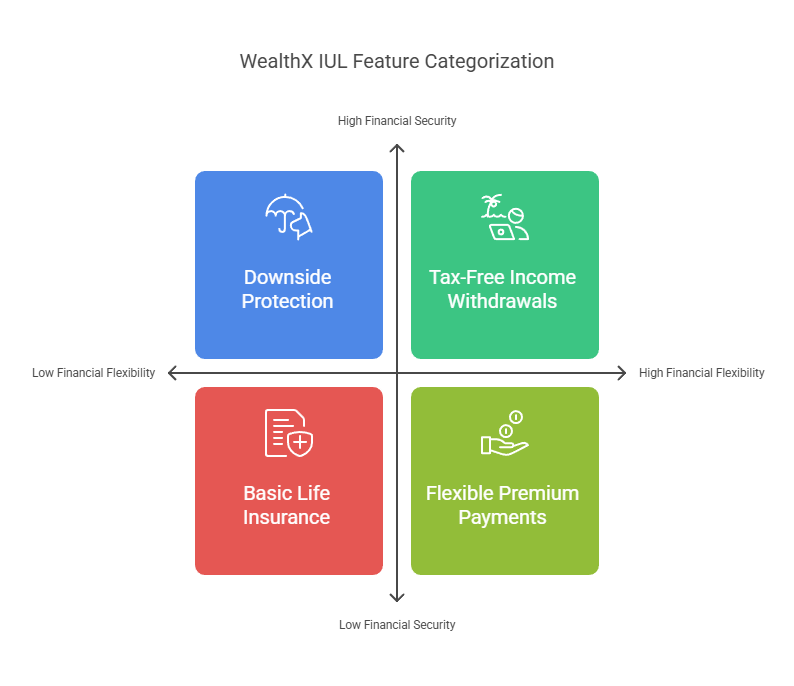

Welcome to the world of WealthX Indexed Universal Life Insurance (IUL), where financial security meets unparalleled growth potential. In this chapter, we’ll delve into the transformative benefits of WealthX IUL and how it can propel you towards your financial goals. Unlike traditional investments that are susceptible to market volatility, WealthX IUL offers a unique blend of downside protection and growth opportunities, ensuring that your financial future remains secure, regardless of market fluctuations.

Downside Protection and Growth Potential: One of the hallmark features of WealthX IUL is its ability to provide downside protection while still offering substantial growth potential. With WealthX IUL, your principal and accumulated interest are shielded from market downturns, safeguarding your hard-earned assets even during periods of economic uncertainty. This invaluable protection ensures that you can weather market volatility with confidence, knowing that your financial future is secure.

Flexibility: WealthX IUL offers unparalleled flexibility, allowing you to tailor your policy to meet your specific financial needs and investment objectives. You have the freedom to allocate your cash value to a variety of indexed accounts, each with its own unique risk profile and growth potential. Whether you prefer a conservative approach or want to capitalize on market opportunities, WealthX IUL offers customizable options to suit your risk tolerance and investment preferences.

Tax-Free Income Withdrawals: Another significant advantage of WealthX IUL is its ability to provide tax-free income withdrawals during retirement. Unlike traditional retirement accounts, which may be subject to taxes on distributions, WealthX IUL allows you to access your cash value without incurring tax liabilities. This tax advantage can significantly enhance your retirement income strategy, providing you with a reliable source of tax-free funds to support your lifestyle during your golden years.

Unlocking Financial Freedom: With WealthX IUL, you have the power to unlock financial freedom and pursue your dreams with confidence. Whether you’re planning for retirement, funding your children’s education, or building a legacy for future generations, WealthX IUL offers the flexibility and security you need to achieve your financial goals. By combining downside protection, growth potential, and tax advantages, WealthX IUL empowers you to take control of your financial future and build the life you’ve always dreamed of.

In the next chapter, we’ll explore in greater detail how WealthX IUL can be integrated into your overall financial plan to maximize its benefits and help you achieve long-term financial security. Get ready to unleash the full potential of WealthX IUL and embark on a journey towards financial freedom and prosperity.

CHAPTER 3: MAXIMIZING YOUR WEALTHX IUL STRATEGY

Welcome to Chapter 3, where we’ll dive into strategies for maximizing the potential of your WealthX Indexed Universal Life Insurance (IUL) policy. From optimizing premium payments to leveraging policy features, there are various techniques to enhance the value of your policy and achieve your long-term financial objectives.

Optimizing Premium Payments: One effective strategy for maximizing your WealthX IUL policy is to optimize your premium payments. By consistently funding your policy, you can accelerate the growth of your cash value, creating a substantial financial safety net and investment vehicle. By committing to regular premium payments, you ensure that your policy remains active and continues to accumulate cash value over time. This disciplined approach can yield significant long-term benefits, providing you with a secure foundation for achieving your financial goals.

Utilizing Policy Loans: Another valuable tool for maximizing your WealthX IUL strategy is leveraging policy loans against your cash value. Policy loans allow you to access funds from your policy’s cash reserve, providing you with liquidity for major expenses or investment opportunities. Whether you need to finance a home renovation, cover medical expenses, or seize a lucrative investment opportunity, policy loans offer a flexible and convenient source of funding. Best of all, because you’re borrowing against your own cash value, there’s no need for credit checks or complex approval processes.

Creating a Legacy: Additionally, you can leverage the death benefit of your WealthX IUL policy to create a lasting legacy for your loved ones. Whether you want to leave an inheritance for your children, support charitable causes, or ensure financial security for future generations, WealthX IUL offers a tax-efficient way to transfer wealth. The death benefit provides your beneficiaries with a lump-sum payment upon your passing, offering financial protection and peace of mind during difficult times. By strategically planning your policy’s death benefit, you can leave a meaningful legacy that reflects your values and priorities.

Exploring Tax Efficiency: WealthX IUL policies also offer tax advantages that can further enhance your overall financial strategy. Because cash value growth is tax-deferred and policy loans are generally tax-free, WealthX IUL provides you with a tax-efficient way to grow and access your wealth. This tax advantage can help you preserve more of your hard-earned assets and maximize your overall financial efficiency.

In the next chapter, we’ll delve deeper into advanced strategies for optimizing your WealthX IUL policy and maximizing its benefits. Get ready to unlock the full potential of your policy and take control of your financial future with confidence.

CHAPTER 4: ADVANCED STRATEGIES FOR MAXIMIZING YOUR WEALTHX IUL POLICY

Welcome to Chapter 4, where we journey into the realm of advanced strategies designed to unlock the full potential of your WealthX Indexed Universal Life Insurance (IUL) policy. As you continue your exploration of WealthX IUL, you’ll discover innovative techniques and tactical maneuvers that will empower you to harness the maximum benefits of your policy and seize control of your financial destiny with unwavering confidence.

- Enhanced Cash Value Growth: In this section, we’ll delve into advanced techniques for accelerating the growth of your cash value within your WealthX IUL policy. From leveraging strategic allocation strategies to optimizing premium payments, you’ll learn how to supercharge your cash value accumulation and build a robust financial foundation for the future.

- Maximizing Tax Efficiency: Tax efficiency is paramount in any financial strategy, and in this segment, we’ll uncover advanced tactics for maximizing the tax advantages offered by your WealthX IUL policy. From utilizing tax-free income withdrawals to implementing strategic tax planning strategies, you’ll gain insights into how to minimize your tax burden and enhance the after-tax returns of your policy.

- Leveraging Policy Loans: Policy loans can be a powerful tool for accessing liquidity and unlocking the value of your WealthX IUL policy, and in this chapter, we’ll explore advanced strategies for leveraging policy loans to your advantage. Whether you’re funding a major purchase, investing in a business venture, or navigating a financial emergency, you’ll learn how to effectively utilize policy loans while preserving the integrity of your policy.

- Incorporating Additional Riders and Benefits: WealthX IUL policies often come with a range of optional riders and benefits that can enhance the overall value and versatility of your policy. In this section, we’ll discuss advanced techniques for incorporating additional riders and benefits into your policy to tailor it to your specific needs and objectives. From long-term care riders to accelerated death benefit riders, you’ll discover how to customize your policy for maximum protection and flexibility.

- Strategic Legacy Planning: Legacy planning is a critical component of any comprehensive financial strategy, and in this segment, we’ll delve into advanced tactics for leveraging your WealthX IUL policy to create a lasting legacy for future generations. Whether you’re looking to transfer wealth to heirs, support charitable causes, or optimize estate tax planning, you’ll learn how to strategically integrate your policy into your broader legacy planning efforts.

By immersing yourself in the advanced strategies outlined in this chapter, you’ll gain the knowledge and expertise needed to maximize the benefits of your WealthX IUL policy and unlock its full potential. Get ready to embark on a journey of financial mastery and take control of your financial future with confidence and clarity.

CONCLUSION: SECURING YOUR FINANCIAL FUTURE WITH WEALTHX IUL

Congratulations on taking the first bold step towards securing your financial future with WealthX Indexed Universal Life Insurance (IUL) from The Policy Shop. As you wrap up your journey through the intricacies of WealthX IUL, you’ve unlocked a powerful arsenal of financial tools and strategies that will serve as the cornerstone of your long-term prosperity.

Through the unique combination of tax-deferred growth, downside protection, and unparalleled flexibility, WealthX IUL stands as a beacon of financial security in an ever-changing landscape. By harnessing the power of these foundational principles, you’ve laid the groundwork for a future defined by stability, growth, and unwavering confidence.

As you move forward on your path to financial freedom, rest assured that our team at The Policy Shop stands ready to support you at every turn. Whether you’re navigating the complexities of retirement planning, safeguarding the financial well-being of your loved ones, or crafting a lasting legacy for future generations, WealthX IUL provides the tools, resources, and expertise you need to achieve your goals with precision and clarity.

Thank you for entrusting The Policy Shop as your partner in financial planning. Your trust and confidence inspire us to continue pushing the boundaries of innovation and excellence, ensuring that you have access to the best possible solutions for securing your financial future.

Take the next step towards a brighter tomorrow. Contact us today to discover how WealthX IUL can empower you to realize your dreams, seize new opportunities, and live the life you’ve always imagined. Your journey to financial security starts here.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.