10 Sep The Advantages of Indexed Universal Life (IUL) Insurance

Advantages of Indexed Universal Life (IUL)

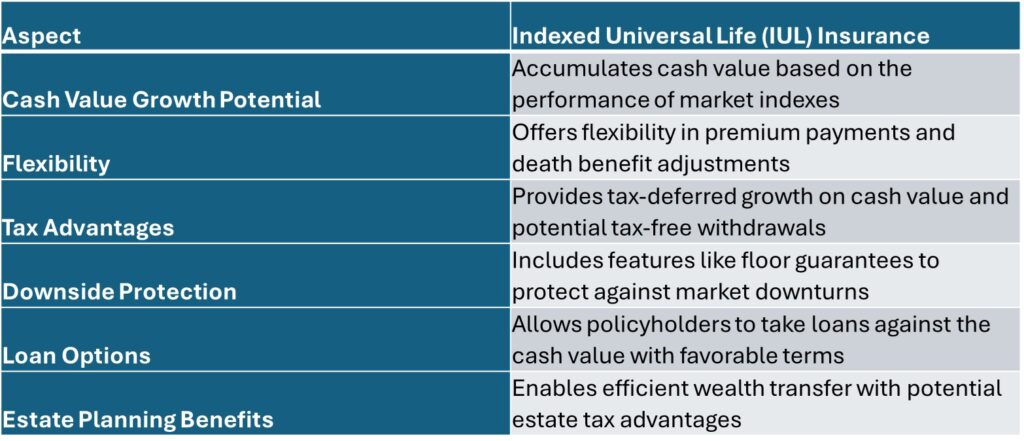

In the realm of life insurance, Indexed Universal Life (IUL) policies have garnered attention for their versatility and potential to enhance long-term financial security. Unlike traditional insurance plans, IUL offers a combination of protection and opportunities, making it a popular choice among individuals seeking to build wealth while safeguarding their loved ones’ futures. This article delves into the distinctive benefits of IUL insurance, shedding light on why it’s increasingly becoming a cornerstone of comprehensive financial planning strategies.

Indexed Universal Life Insurance (IUL): Unlocking Financial Flexibility and Growth Potential

Benefits of IUL:

-

- Flexible premiums: Adjust your premium payments according to your financial situation.

- Cash value accumulation: Build cash value over time, which grows tax-deferred.

- Indexed interest options: Potential for higher returns based on the performance of market indexes.

- Death benefit protection: Provides a death benefit to your beneficiaries upon your passing.

Tailored to your needs: IUL policies offer a unique combination of flexibility, growth potential, and death benefit protection. With the ability to customize your premiums and access cash value accumulation, IUL can serve as a versatile financial tool for long-term planning. Explore the benefits of IUL to secure your financial future with confidence.

Indexed Universal Life (IUL) insurance stands out as a dynamic financial tool that combines the protection of traditional life insurance with the potential for wealth accumulation and tax advantages. With its unique features such as cash value growth tied to market indexes and flexibility in premium payments, IUL offers a tailored approach to long-term financial planning. By understanding the distinct advantages outlined in this overview, individuals can leverage IUL policies to achieve their financial goals, whether it’s funding retirement, leaving a legacy, or protecting against market volatility.

Contact us today to begin your journey toward securing your legacy with The Policy Shop. Together, we’ll create a brighter tomorrow for you and your loved ones.