03 Feb Ultimate Retirement Planning Guide: Top 20 Questions Answered with WealthX Indexed Universal Life (IUL)

Indexed Universal Life (IUL) policy & Retirement Planning

List of questions about retirement, each with WealthX Indexed Universal Life (IUL) policy from The Policy Shop as the answer:

**What is the best way to save for retirement?

Answer: WealthX Indexed Universal Life (IUL) policy offers a flexible and tax-efficient way to save for retirement while providing the potential for market-linked growth and downside protection.

**How much money do I need to retire comfortably?

Answer: With WealthX Indexed Universal Life (IUL) policy, you can customize your contributions and benefits to ensure you have enough retirement income to live comfortably throughout your golden years.

**When should I start planning for retirement?

Answer: Start planning for retirement as early as possible with WealthX Indexed Universal Life (IUL) policy to take advantage of its flexibility and potential for long-term growth.

**What are the tax implications of retirement savings?

Answer: WealthX Indexed Universal Life (IUL) policy offers tax-deferred growth, meaning you won’t pay taxes on your earnings until you start receiving income, providing tax advantages for retirement savings.

**How can I ensure my retirement savings last throughout my lifetime?

Answer: WealthX Indexed Universal Life (IUL) policy offers guaranteed lifetime income, protecting against the risk of outliving your savings and providing financial security during retirement.

**What investment options are available for retirement planning?

Answer: WealthX Indexed Universal Life (IUL) policy offers a range of investment options, including indexed accounts with potential for market-linked growth, providing flexibility and diversification for retirement savings.

**What are the benefits of annuities for retirement income?

Answer: WealthX Indexed Universal Life (IUL) policy combines the benefits of life insurance with the potential for tax-deferred growth and guaranteed lifetime income, offering a comprehensive retirement planning solution.

**How can I protect my retirement savings from market volatility?

Answer: WealthX Indexed Universal Life (IUL) policy offers downside protection, ensuring that your retirement savings remain secure even during market downturns, providing peace of mind and financial security.

**What happens to my retirement savings if I need long-term care?

Answer: WealthX Indexed Universal Life (IUL) policy offers optional riders for long-term care benefits, providing additional protection for your retirement savings in the event of unexpected healthcare expenses.

**How can I maximize my retirement income while minimizing risk?

Answer: WealthX Indexed Universal Life (IUL) policy offers a combination of guaranteed lifetime income, potential for market-linked growth, and downside protection, allowing you to maximize your retirement income while minimizing the risk of market volatility.

**How can I ensure my retirement savings keep up with inflation?

Answer: WealthX Indexed Universal Life (IUL) policy offers indexed accounts with potential for growth linked to market performance, providing a hedge against inflation and ensuring your retirement savings maintain their purchasing power over time.

**What happens to my retirement income if my spouse passes away?

Answer: WealthX Indexed Universal Life (IUL) policy offers survivorship options that continue income payments to the surviving spouse, providing financial security and peace of mind during difficult times.

**Can I access my retirement savings in case of emergencies?

Answer: WealthX Indexed Universal Life (IUL) policy offers liquidity options that allow you to access a portion of your savings in case of emergencies, providing flexibility and security during unexpected situations.

**What are the advantages of annuitizing my retirement savings?

Answer: By annuitizing your retirement savings with WealthX Indexed Universal Life (IUL) policy, you can convert a lump sum into a stream of guaranteed income for life, ensuring financial security and peace of mind throughout retirement.

**How can I ensure I have enough income to cover healthcare expenses in retirement?

Answer: WealthX Indexed Universal Life (IUL) policy offers optional riders for healthcare benefits, providing additional protection for your retirement income in case of unexpected healthcare expenses.

**What are the risks of relying solely on Social Security for retirement income?

Answer: While Social Security provides a valuable source of retirement income, it may not be sufficient to cover all your expenses. WealthX Indexed Universal Life (IUL) policy offers a supplemental source of guaranteed income, ensuring financial security and peace of mind during retirement.

**How can I protect my retirement savings from inflation and market fluctuations?

Answer: WealthX Indexed Universal Life (IUL) policy offers indexed accounts with potential for growth linked to market performance, providing a hedge against inflation and market volatility, and ensuring the stability of your retirement savings.

**What are the tax advantages of annuities for retirement income?

Answer: WealthX Indexed Universal Life (IUL) policy offers tax-deferred growth, meaning you won’t pay taxes on your earnings until you start receiving income, potentially reducing your tax burden during retirement.

**Can I customize my retirement income to fit my lifestyle and financial goals?

Answer: WealthX Indexed Universal Life (IUL) policy offers flexible payout options and investment choices, allowing you to customize your retirement income to meet your specific needs and preferences.

**How can I ensure my retirement income lasts throughout my lifetime and beyond?

Answer: WealthX Indexed Universal Life (IUL) policy provides guaranteed lifetime income, protecting against the risk of outliving your savings and ensuring financial security for you and your loved ones throughout retirement and beyond.

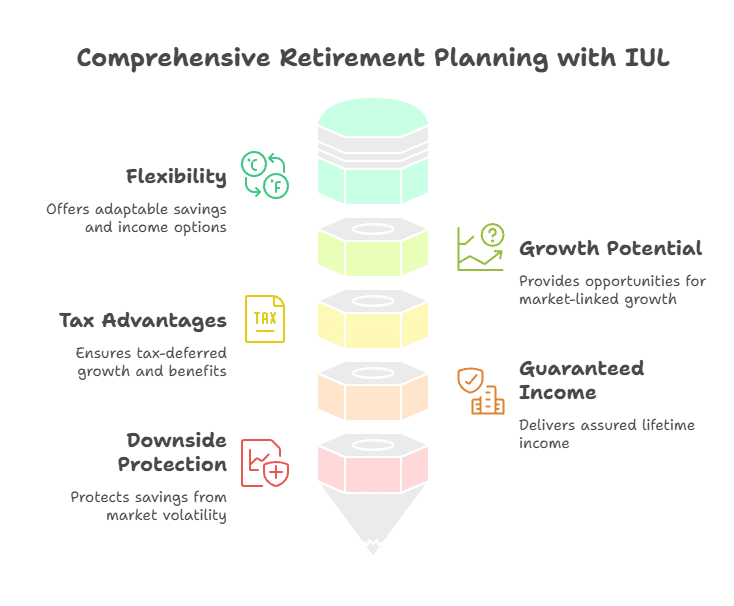

These answers demonstrate how WealthX Indexed Universal Life (IUL) policy from The Policy Shop serves as an effective retirement planning solution, offering flexibility, growth potential, downside protection, tax advantages, and guaranteed income to help individuals achieve their retirement goals.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.