04 Feb Understanding Indexed Universal Life Insurance (IUL): A Comprehensive Guide

Understanding Indexed Universal Life Insurance (IUL)

Everything You Need to Know About Indexed Universal Life Insurance (IUL)

Indexed Universal Life (IUL) insurance policies have gained popularity as a flexible and customizable option for life insurance coverage. In this article, we’ll discuss the nuances of IUL insurance, exploring how it works, its unique features, and the benefits it offers for financial planning and protection. Whether you’re new to IUL or seeking to deepen your understanding, this information will equip you with the knowledge to make better decisions about your life insurance needs.

Explaining Indexed Universal Life Insurance:

Indexed Universal Life (IUL) insurance is a type of permanent life insurance that offers both a death benefit and a cash value component. Unlike traditional universal life insurance, the cash value in an IUL policy is tied to the performance of stock market indexes, such as the S&P 500. This allows policyholders to potentially earn higher returns on their cash value’ while still enjoying protection against negative returns. IUL has a unique floor rate feature that prevents the loss of principle or accumulated interest, while still offering the benefit of interest credited to positive market performance.

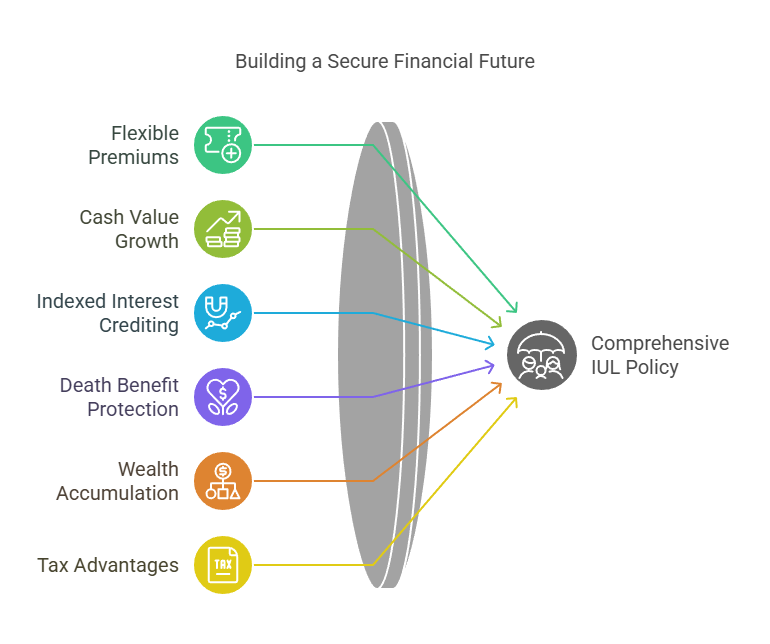

Key Features of Indexed Universal Life Insurance:

-

- Flexible Premiums: IUL policies offer flexibility in premium payments, allowing policyholders to adjust their premiums over time to accommodate changes in their financial circumstances.

- Cash Value Growth: The cash value in an IUL policy grows tax-deferred, meaning policyholders can accumulate wealth over time without paying taxes on the growth.

- Indexed Interest Crediting: IUL policies credit interest based on the performance of a stock market index, with a guaranteed minimum interest rate to protect against market downturns.

- Death Benefit Protection: Like other permanent life insurance policies, IUL provides a death benefit to beneficiaries upon the policyholder’s death, providing financial protection for loved ones.

Benefits of Indexed Universal Life Insurance:

-

- Wealth Accumulation: IUL policies offer the potential for significant cash value accumulation over time, providing a source of supplemental retirement income or funding for future expenses.

- Tax Advantages: The tax-deferred growth and generally tax-free death benefit of IUL policies make them attractive options for individuals seeking to minimize their tax burden and maximize their legacy.

- Flexibility: IUL policies offer flexibility in premium payments, death benefit options, and access to cash value, allowing policyholders to customize their coverage to meet their unique needs and goals.

Indexed Universal Life (IUL) insurance policies offer a powerful combination of protection and flexibility for individuals seeking comprehensive life insurance coverage. By understanding how IUL works, its key features, and the benefits it offers, you can make informed decisions about incorporating IUL into your financial plan. Whether you’re planning for retirement, protecting your loved ones, or building wealth for the future, IUL can be a valuable tool in achieving your financial goals.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.