04 Feb The Ultimate Guide to Indexed Universal Life Insurance (IUL)

Guide to Indexed Universal Life Insurance (IUL)

The Ultimate Guide to Indexed Universal Life Insurance (IUL): Everything You Need to Know

In today’s uncertain economic climate, securing your family’s financial future is more complicated than ever. WealthX Indexed Universal Life Insurance (IUL) stands as a tool for financial growth and security, offering unparalleled benefits and flexibility. Dive deep into the world of IUL as we explore WealthX’s features, advantages, and how it can create the most opportunistic future.

Understanding the Basics of WealthX IUL

WealthX combines the protection of traditional life insurance with the potential for cash value growth linked to the performance of market indices. Unlike traditional whole life policies, WealthX IUL offers greater flexibility in premium payments and cash value accumulation.

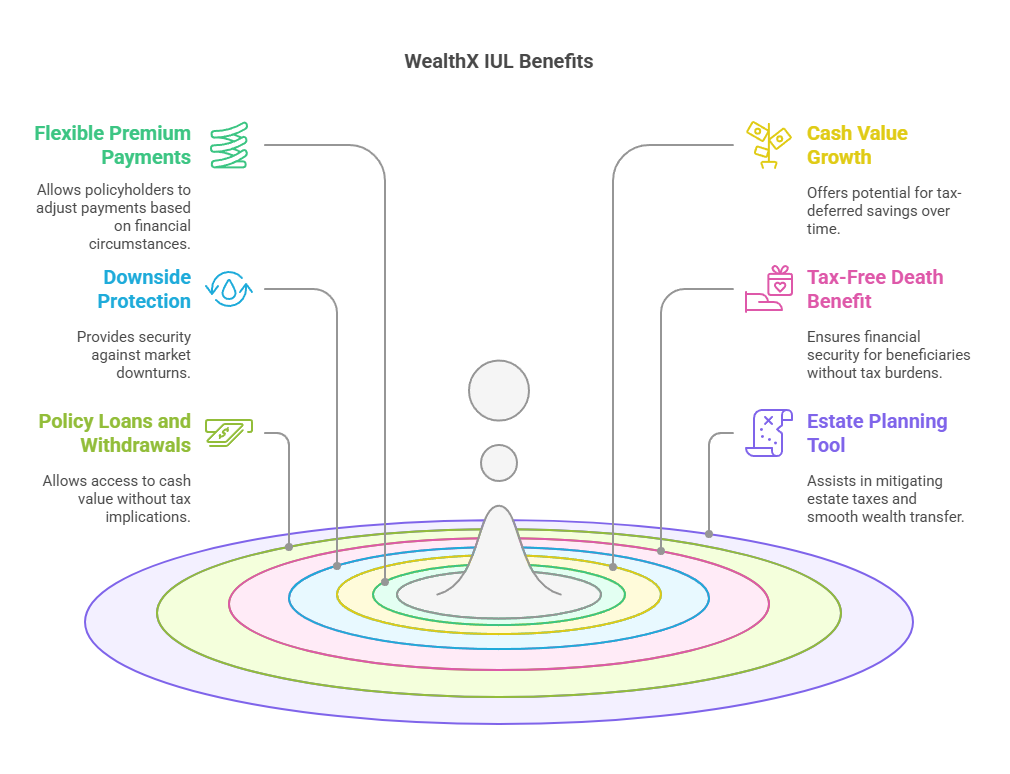

Benefits of WealthX Indexed Universal Life Insurance

Flexible Premium Payments:

WealthX IUL allows policyholders to adjust their premium payments based on their financial situation, providing breathing room during challenging times.

Example: John, a 45-year-old entrepreneur, faces fluctuating income streams. With WealthX IUL, he can adapt his premium payments to match his cash flow, ensuring continuous coverage for his family.

Cash Value Growth Potential:

The cash value component of WealthX IUL policies has the potential to grow over time, offering a source of tax-deferred savings.

Example: Sarah, a 35-year-old professional, sees WealthX IUL as a long-term financial tool. By leveraging the policy’s cash value growth, she aims to fund her children’s college education while securing life insurance coverage.

Downside Protection:

While WealthX IUL allows policyholders to participate in market gains, it also offers downside protection, ensuring that the cash value doesn’t decrease in a market downturn.

Example: Michael, nearing retirement at 60, prioritizes protecting his nest egg. With WealthX IUL, he enjoys the potential for market-linked returns without the fear of losing principal or previously accumulated interest during market downturns.

Tax-Free Death Benefit:

The death benefit paid out to beneficiaries is typically tax-free, providing financial security and peace of mind to loved ones.

Example: Emily, a single mother, seeks to leave a legacy for her children. With WealthX IUL, she ensures that her beneficiaries receive the death benefit tax-free, offering a financial safety net in her absence.

Policy Loans and Withdrawals:

WealthX IUL policies allow policyholders real-time access to cash value tax-free, providing liquidity in times of need.

Example: James, a 50-year-old homeowner, faces unexpected medical expenses. By taking out a policy loan against his WealthX IUL, he covers the costs without disrupting his long-term financial goals.

Estate Planning Tool:

WealthX IUL can serve as a powerful estate planning tool, helping to mitigate estate taxes and ensure a smooth transfer of wealth to future generations.

Example: The Smith family, with a substantial estate, leverages WealthX IUL to minimize estate taxes and provide for their children and grandchildren’s future financial needs.

Why Choose The Policy Shop’s WealthX IUL Policy

The Policy Shop‘s WealthX IUL policy stands out as the optimal choice for securing your family’s financial future. With professional support to match WealthX to your needs, robust cash value growth potential, and a range of customizable options, our WealthX IUL policy offers maximum growth opportunity with unrivaled peace of mind.

Contact The Policy Shop Today

Ready to take the next step towards financial security? Contact The Policy Shop today to learn more about our WealthX IUL policy and how it can benefit you and your family. Our experienced team of insurance experts is here to guide you through the process and help you make informed decisions for a brighter tomorrow.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.