03 Feb What Are Indexed Universal Life (IUL) Policies?

What Are Indexed Universal Life (IUL) Policies?

Demystifying Indexed Universal Life (IUL) Policies: Everything You Need to Know

Indexed Universal Life (IUL) policies are a type of permanent life insurance that offer both a death benefit and a cash value component. Let’s delve into the specifics of IUL policies and how they work.

Answer: Indexed Universal Life (IUL) policies are life insurance products that combine the protection of a death benefit with the potential for cash value accumulation based on the performance of a stock market index, such as the S&P 500.

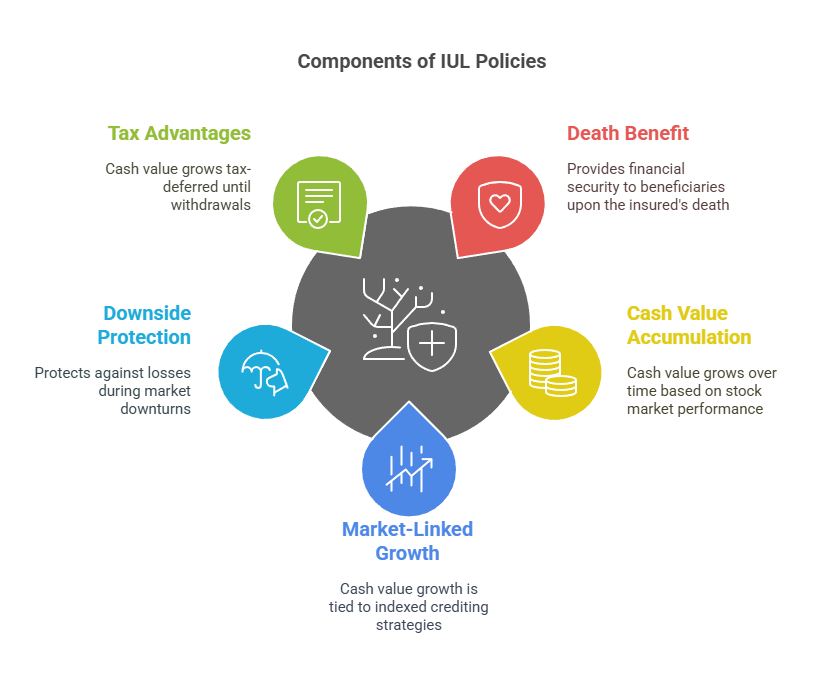

Death Benefit:

Like other types of life insurance, IUL policies provide a death benefit that is paid out to beneficiaries upon the insured individual’s death. This benefit can help provide financial security to loved ones and cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

Cash Value Accumulation:

In addition to the death benefit, IUL policies also offer a cash value component that accumulates over time. The cash value grows based on the performance of a designated stock market index, with the potential for higher returns compared to traditional universal life insurance policies.

Market-Linked Growth:

Unlike traditional universal life insurance, where the cash value is tied to fixed interest rates, IUL policies allow policyholders to participate in the potential growth of the stock market through indexed crediting strategies. This means that the cash value has the opportunity to increase based on the positive performance of the chosen index, up to a certain cap.

Downside Protection:

While IUL policies offer the potential for market-linked growth, they also typically come with downside protection features that limit losses in the event of market downturns. This ensures that the cash value does not decrease when the index experiences negative returns, providing a level of security for policyholders.

Tax Advantages:

Similar to other permanent life insurance policies, IUL policies offer tax-deferred growth on the cash value accumulation. This means that policyholders can grow their cash value without paying taxes on the gains until they make withdrawals or surrender the policy. Additionally, death benefits paid out to beneficiaries are generally income tax-free.

Example: For example, John purchases an Indexed Universal Life (IUL) policy with a death benefit of $500,000 and allocates a portion of his premiums to an indexed account linked to the S&P 500. Over time, as the stock market index performs positively, the cash value of John’s policy grows, providing him with an additional source of tax-deferred savings for retirement.

Conclusion: Indexed Universal Life (IUL) policies offer a unique combination of death benefit protection and cash value accumulation linked to the performance of a stock market index. With the potential for market-linked growth, downside protection, and tax advantages, IUL policies provide policyholders with a versatile financial tool for long-term wealth accumulation and protection.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.