04 Feb What Are the Benefits of Indexed Universal Life Insurance (IUL)?

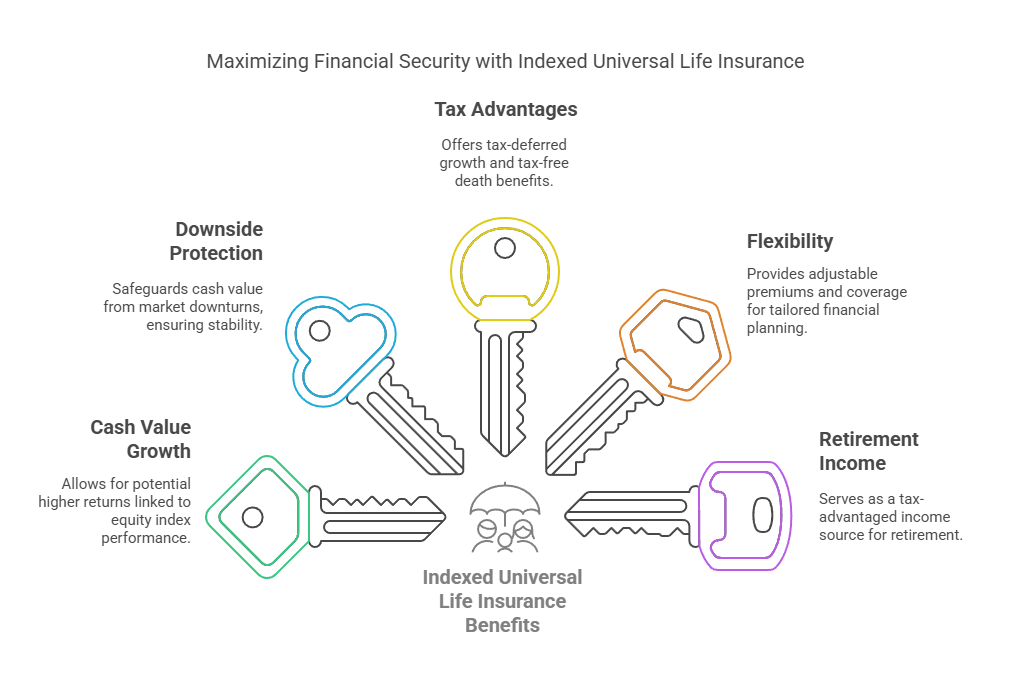

Benefits of Indexed Universal Life Insurance (IUL)

Indexed Universal Life Insurance (IUL) is a unique type of life insurance policy that offers several benefits. The Policy Shop explores the advantages of IUL and how it can help you meet your financial goals.

Answer: Some key benefits of Indexed Universal Life Insurance include:

Potential for Cash Value Growth:

IUL policies offer the opportunity for cash value accumulation based on the performance of an equity index, such as the S&P 500. This provides policyholders with the potential for higher returns compared to traditional universal life insurance policies.

Downside Protection:

IUL policies often come with downside protection features that safeguard the policy’s cash value against market downturns. Even if the underlying index experiences negative returns, the policy’s cash value won’t decrease, providing a level of security for policyholders.

Tax Advantages:

Like other permanent life insurance policies, IULs offer tax-deferred growth on cash value accumulation. This means that policyholders can grow their cash value over time without paying taxes on the gains until they withdraw the funds. Additionally, death benefits paid out to beneficiaries are generally income tax-free.

Flexibility:

IUL policies typically offer flexibility in premium payments, death benefits, and cash value management. Policyholders can adjust their premiums and coverage levels to suit their changing financial needs and goals, providing a customizable solution for long-term financial planning.

Retirement Income:

IUL policies can also serve as a retirement planning tool, providing a source of tax-advantaged income during retirement. Policyholders can access their cash value through loans or withdrawals, supplementing other retirement income sources like pensions and Social Security.

Example: For example, Sarah purchases an IUL policy and allocates a portion of her premium payments to an indexed account linked to the performance of the S&P 500. Over time, her cash value grows tax-deferred, providing her with supplemental income in retirement while also protecting her loved ones with a death benefit.

Conclusion:

Indexed Universal Life Insurance offers a range of benefits, including potential cash value growth, downside protection, tax advantages, flexibility, and retirement income options. It’s essential to consider these advantages when exploring life insurance options to meet your financial needs and goals.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.