04 Feb What Is Indexing? | How Does It Work?

What Is Indexing?

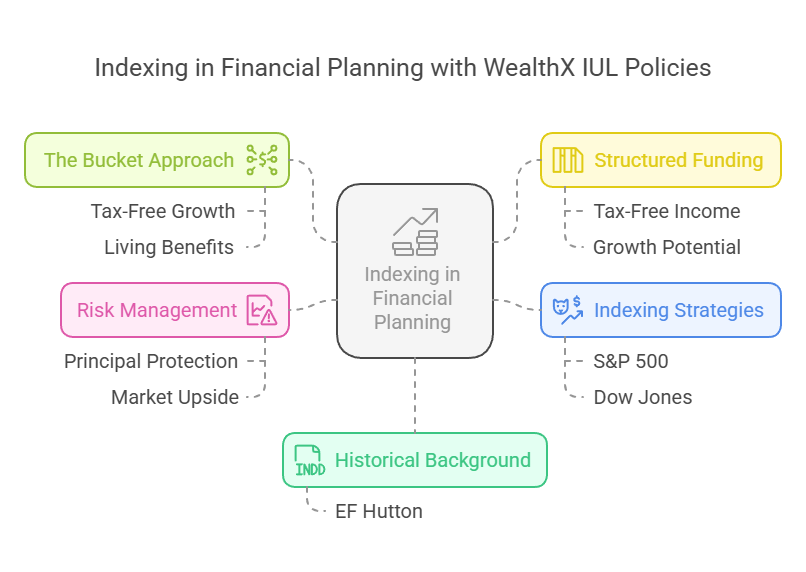

In this article, we’re diving into the concept of indexing and how it works within the context of financial planning, particularly with WealthX Indexed Universal Life (IUL) policies. By the end of this discussion, you’ll have a solid understanding of how indexing allows you to participate in the upside potential of the market without exposing your money to the risks inherent in direct market investments.

Introduction to Indexing:

Indexing, within the realm of financial instruments like WealthX IUL policies, offers a unique opportunity to leverage market growth without directly investing in the market itself. This means you can potentially benefit from market gains while safeguarding your principal against market downturns.

Historical Background:

Indexing traces back to 1980 when EF Hutton first introduced the concept. Instead of channeling funds directly into the market, EF Hutton recognized the stability and growth potential of the insurance industry, leading to the creation of indexed universal life policies.

The Bucket Approach:

Analogous to a bucket, indexed universal life policies serve as a repository for your funds. Structuring the policy involves determining the amount of money you want to contribute, ensuring tax-free growth and access to funds, with a focus on minimizing insurance costs while maximizing living benefits.

Structured Funding:

Funding your policy involves a strategic approach, such as spreading contributions over several years to optimize tax-free income and growth potential. For instance, funding a policy with $500,000 over five years, with maximum yearly contributions capped at 20%, can secure tax-free access to accumulated funds.

Indexing Strategies:

Indexing within WealthX IUL policies offers diverse options to link your funds to indices like the S&P 500 or the Dow Jones. This allows you to tailor your investment strategy to match your risk tolerance and market outlook while potentially earning higher returns than traditional fixed-rate options.

Risk Management:

Unlike direct market investments or index mutual funds, where your money is directly exposed to market fluctuations, indexing within IUL policies provides a safeguard against market downturns. By relinquishing a fixed interest rate, you allow the insurance company to fund options tied to market indices, offering potential upside while protecting your principal.

Historical Performance:

Historical data demonstrates the effectiveness of indexing strategies, especially during volatile market periods. While direct market investments may experience significant fluctuations, indexing within IUL policies can provide steady growth and protection against losses, ultimately resulting in substantial tax-free gains over time.

Conclusion and Resources:

Understanding indexing and its application within WealthX IUL policies can be pivotal in achieving long-term financial goals.

Contact The Policy Shop to learn more about WealthX IUL and how it can transform your financial future. Start building your legacy of tax-free wealth today.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.