27 Jan Life Insurance: Your Simplified Guide | Grid Format

Life Insurance Guide

Choosing the right life insurance policy is a crucial decision that can have a significant impact on your financial future and that of your loved ones. With so many options available, it can be overwhelming to navigate the world of life insurance. At The Policy Shop, we’re committed to helping you make informed choices about your insurance needs. In this guide, we’ll explore the various types of life insurance policies, including Indexed Universal Life (IULs) and Annuities, providing clear descriptions and key attributes to help you understand your options better.

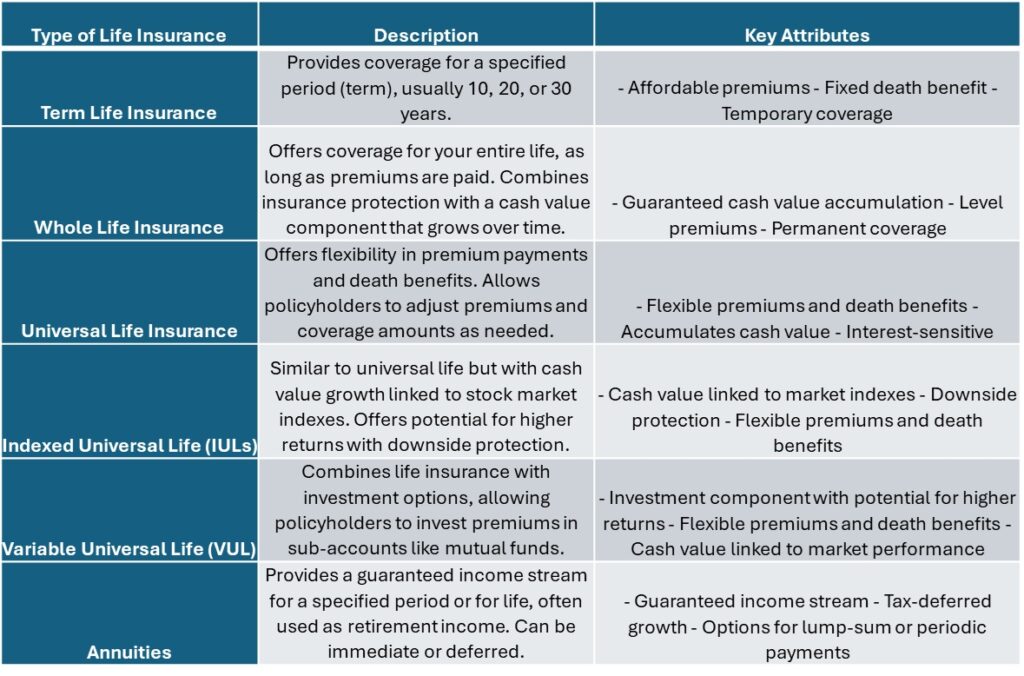

Life insurance comes in various forms, each with its own features and benefits. Term life insurance offers affordable coverage for a specific period, while whole life insurance provides lifelong protection with guaranteed cash value accumulation. Universal life insurance offers flexibility in premium payments and death benefits, and Indexed Universal Life (IULs) provide potential for higher returns with downside protection. Variable Universal Life (VUL) combines life insurance with investment options, and annuities offer guaranteed income streams for retirement. Understanding the differences between these types of policies can help you choose the one that best suits your needs and financial goals.

Choosing the right life insurance policy is an essential step in securing your financial future and protecting your loved ones. By understanding the various types of life insurance policies available, including Indexed Universal Life (IULs) and Annuities, you can make informed decisions that align with your unique needs and goals. At The Policy Shop, we’re here to provide guidance and support every step of the way, helping you find the perfect policy to safeguard your family’s future.

Contact us today to begin your journey toward securing your legacy with the right insurance policy, designed around you and your family, from The Policy Shop. Together, we’ll create a brighter tomorrow for you and your loved ones.