03 Feb Securing Your Golden Years: Retirement Income

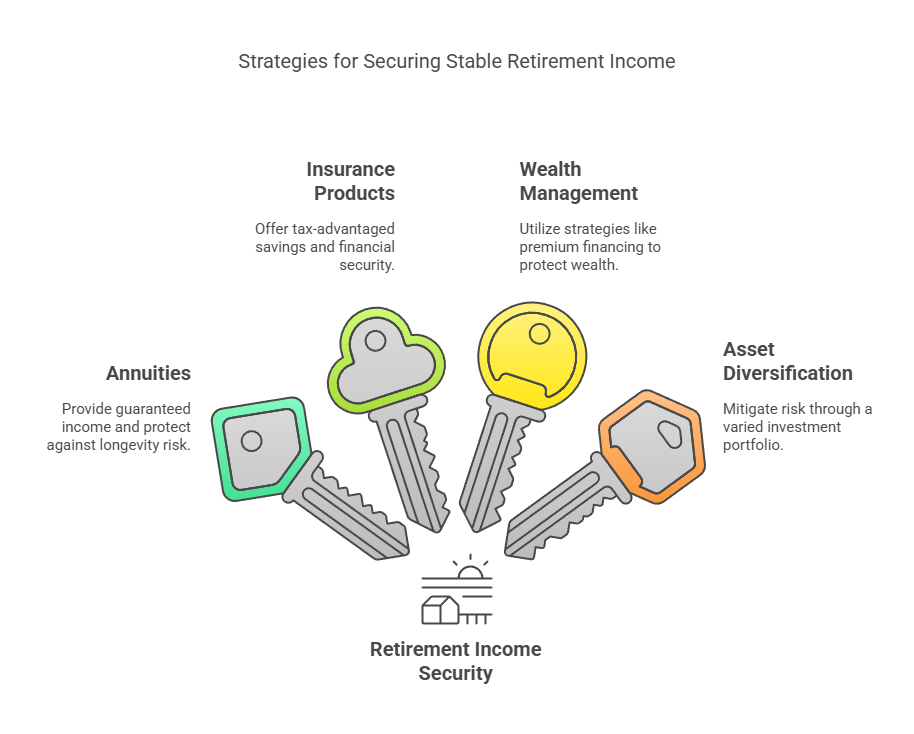

Top Strategies for Guaranteed Retirement Income

Welcome to a newfound sense of financial security as you approach your retirement. Imagine living your dream retirement life without the nagging fear of outliving your savings. With the right strategies, a guaranteed retirement income is within your grasp. Here at The Policy Shop, we understand the importance of reliable income streams that offer peace of mind during your golden years. In this article, we delve into the strategies that can help you secure a lifetime of financial comfort and stability.

Understanding Annuities as a Retirement Income Source

Annuities stand out as a favored option for many retirees seeking guaranteed income. A product like RetirementPAYDAY can provide you with a consistent paycheck, mimicking the regular income you once earned from working. Studies from well-respected institutions such as the Brookings Institution have highlighted the benefits of annuities in retirement planning.

- They offer a hedge against longevity risk, ensuring you do not outlive your assets.

- Fixed annuities give you a predictable income, which can be a bedrock for other investment ventures.

- Variable annuities, while riskier, have the potential for growth, keeping pace with inflation.

Employing Insurance Products for Financial Security

Insurance products are often overlooked as a means of wealth creation. However, vehicles like WealthX and CollegePLUS Indexed Universal Life Insurance policies provide more than just a death benefit. These products can serve as a source of tax-advantaged savings and income, which can be utilized in retirement. Furthermore, the components of LifeENSURE combine the best features of whole and term life insurance, ensuring that your family’s financial needs are met while potentially contributing to your retirement income.

Benefits of Life Insurance in Retirement Planning

- Access to cash value accumulations can supplement retirement income.

- Tax benefits make these insurance products valuable assets in retirement.

- Flexibility in policy structure can cater to changing needs over time.

Strategic Wealth Management with Premium Financing

For high-net-worth individuals, BespokeFINANCE offers a sophisticated approach to managing and preserving wealth. By leveraging premium financing, clients can maintain their lifestyles while protecting wealth for future generations. This strategy, covered by leading financial authorities like Forbes, involves using borrowed funds to pay for life insurance premiums, which can then play a pivotal role in retirement and estate planning.

Asset Diversification and Strategies

While insurance products and annuities lay the groundwork for guaranteed income, a diversified portfolio can address your financial needs holistically. Including a mix of stocks, bonds, and other investment vehicles adds layers of potential growth to your retirement corpus. The wisdom of diversified investing is supported by the likes of Investopedia, advocating for a balanced approach to managing risk and pursuing growth.

Key Tips:

- Diversify across different asset classes to mitigate risk.

- Consider your risk tolerance and adjust your portfolio accordingly as you near retirement.

- Stay informed and adjust your tactics in response to changing market conditions.

In conclusion, a well-structured financial plan for your retirement can ensure that you enjoy your golden years with the confidence that comes from guaranteed income streams. At The Policy Shop, located in the heart of Delray Beach, FL, our dedicated team is ready to guide you through the myriad of options available. We invite you to contact us for a personalized consultation to secure your financial future.

________________________________________________________________________________________________________________________________________________

- Secure Your Future with The Policy Shop

Explore our comprehensive life insurance solutions designed to fit your financial goals and protect your loved ones. Whether you’re planning for retirement, safeguarding your family’s future, or exploring innovative insurance strategies, The Policy Shop is your trusted partner in financial security.

Ready to take the next step? Contact our expert advisors to discuss your insurance needs and find the perfect policy.

Subscribe to our newsletter for the latest insights on life insurance, financial planning tips, and exclusive updates from The Policy Shop.